Pradhan Mantri Mudra Yojana completes 10 years, Over 50 crore Loans Sanctioned

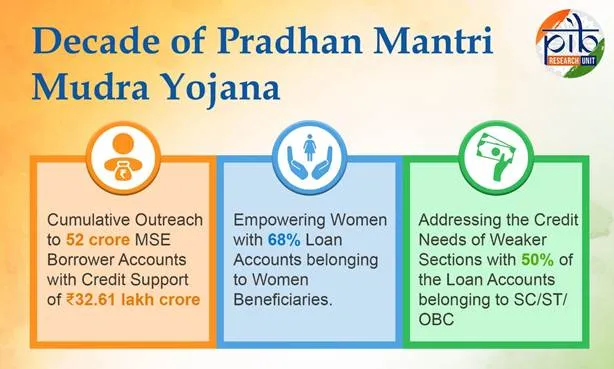

On 8th April 2025, India celebrated 10 years of the Pradhan Mantri MUDRA Yojana (PMMY) — a transformative government scheme that has changed the face of small business financing in the country. Since its inception, over 52 crore loans worth ₹32.61 lakh crore have been sanctioned under the scheme.

Launched in April 2015, PMMY is a flagship initiative of the Prime Minister aimed at supporting micro and small businesses that often struggle to get bank loans due to lack of collateral or formal credit history. By removing the need for security and simplifying the loan process, MUDRA has opened doors for millions of individuals who once found it nearly impossible to get financial help for their small enterprises.

In these ten years, the scheme has brought meaningful change to the lives of countless Indians. From tea stalls and tailoring shops to beauty salons, garages, and mobile repair businesses, crores of micro-entrepreneurs have confidently taken the leap into self-employment. This has been possible because PMMY offered formal institutional credit to micro and small enterprises outside the corporate and agricultural sectors. These small businesses form the backbone of India’s economy, and PMMY has played a critical role in supporting them.

Pradhan Mantri Mudra Yojana Achievements

| Parameter | Details |

|---|---|

| Financial Year | 2024–2025 |

| No. of PMMY Loans Sanctioned | 4,79,48,320 |

| Amount Sanctioned | ₹5,02,782.13 Crore |

| Amount Disbursed | ₹4,91,787.92 Crore |

PMMY Performance: 2023-24

A report by the State Bank of India shows how the scheme has boosted credit to Micro, Small and Medium Enterprises (MSMEs). In FY14, MSME credit stood at ₹8.51 lakh crore. By FY24, it had jumped to ₹27.25 lakh crore, and is expected to cross ₹30 lakh crore in FY25. This rapid growth shows how Mudra has empowered businesses, especially in small towns and rural areas, by making credit easily accessible and boosting self-employment.

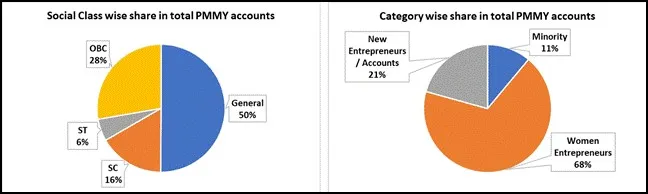

One of the most remarkable aspects of PMMY is how it has promoted financial inclusion for women. Around 68% of Mudra beneficiaries are women, showing the scheme’s strong support for women-led businesses. From FY16 to FY25, the average loan amount per woman borrower increased at a rate of 13% annually, reaching ₹62,679. Their average savings also rose significantly. States that provided more loans to women saw higher levels of employment generation in women-led businesses, highlighting the power of targeted financial support in boosting women’s role in the economy.

PMMY has also extended its reach to socially marginalized communities. According to the SBI report, 50% of all Mudra accounts belong to Scheduled Castes (SC), Scheduled Tribes (ST), and Other Backward Classes (OBC), while 11% are held by people from minority communities. This shows that Mudra is helping traditionally excluded groups gain access to the formal financial system, promoting inclusive development.

Over the years, MUDRA has also supported entrepreneurs in growing their businesses. Loans under the scheme are offered in three categories—Shishu (up to ₹50,000), Kishor (₹50,000 to ₹5 lakh), and Tarun (₹5 lakh to ₹10 lakh). In recent years, the share of Kishor and Tarun loans has grown steadily. For instance, Kishor loans have increased from just 5.9% in FY16 to 44.7% in FY25. This rise reflects a shift from just starting businesses to helping them expand and scale.

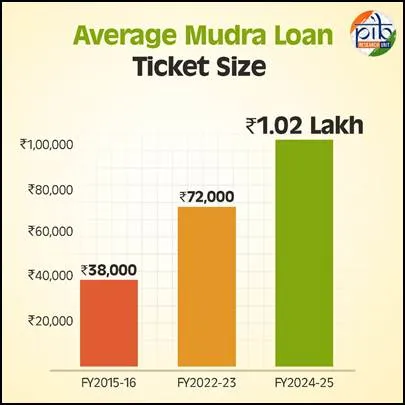

The average loan size under the scheme has also increased significantly—from ₹38,000 in FY16 to ₹72,000 in FY23, and now touching ₹1.02 lakh in FY25. This shows that businesses are growing in size, and more entrepreneurs are taking bigger loans to build stronger businesses. In FY23 alone, loan disbursals rose by 36%, which is a clear sign of renewed confidence among small business owners.

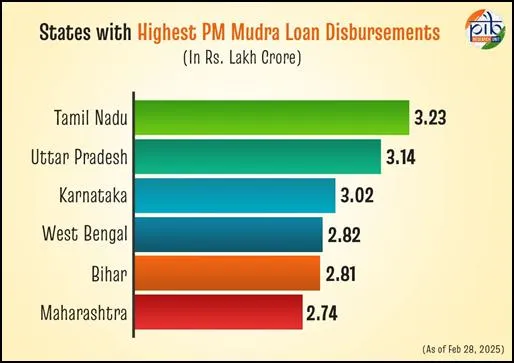

State-wise data also reveals the wide reach of PMMY. As of February 2025, Tamil Nadu has topped the list with the highest loan disbursal of ₹3.23 lakh crore, followed by Uttar Pradesh with ₹3.14 lakh crore, and Karnataka with ₹3.02 lakh crore. West Bengal, Bihar, and Maharashtra also recorded high disbursal amounts, showing the scheme’s strong presence across diverse regions. Among Union Territories, Jammu & Kashmir has performed remarkably well, with ₹45,816 crore disbursed across over 21 lakh loan accounts, reflecting the scheme’s success in remote areas as well.

India has over 10 crore micro enterprises, making this sector the second largest employer after agriculture. These businesses range from manufacturing and retail to service providers, often run by individuals or small groups. Most of them are informal or unregistered, and had limited access to formal credit. PMMY stepped in to solve this problem, enabling these “funding the unfunded” businesses to grow and create jobs.

The Micro Units Development and Refinance Agency (MUDRA) was created to handle and promote these small loans. PMMY allows borrowers to take collateral-free loans up to ₹20 lakh from various lenders including commercial banks, regional rural banks, non-banking finance companies, and micro-finance institutions. A special category called Tarun Plus (loans above ₹10 lakh to ₹20 lakh) has been introduced to support businesses that have previously taken and successfully repaid loans.

The scheme has even received international praise. The International Monetary Fund (IMF) has repeatedly appreciated PMMY for helping expand financial access and supporting women entrepreneurs. In 2017, the IMF recognized how Mudra supported women-led businesses, especially when combined with the Jan Dhan Yojana. In 2019, it highlighted the importance of Mudra loans for businesses engaged in manufacturing, trading, and services. By 2023, the IMF noted the sharp rise in women-owned MSMEs supported by Mudra, now exceeding 28 lakh businesses. In its 2024 report, the IMF again confirmed that India’s policy support through Mudra is boosting self-employment and formalizing small businesses.