PNB Puts Over ₹760 Crore Bad Loans on Auction

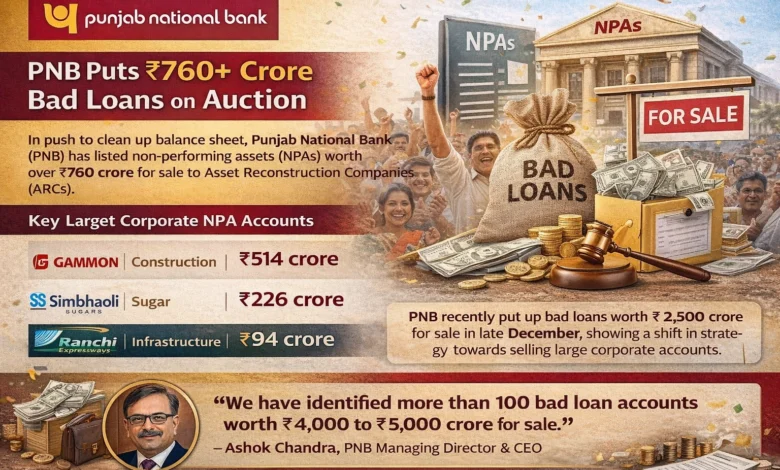

Punjab National Bank (PNB) has stepped up its efforts to clean up its balance sheet by putting bad loans worth more than ₹760 crore on the auction block. The bank is offering these non-performing assets (NPAs) for sale to asset reconstruction companies as part of its ongoing recovery strategy.

The latest auction includes some big corporate names, with exposure spread across key sectors like construction, sugar, and infrastructure. Among the largest accounts on offer is Gammon India, with outstanding dues of ₹514 crore linked to the civil construction sector. Simbhaoli Sugars, from the sugar industry, accounts for ₹226 crore, while Ranchi Expressways, an infrastructure firm, has dues of ₹94 crore.

Apart from these major borrowers, PNB is also looking to sell smaller stressed loan accounts of companies such as Shree Basaveshwar Sugars, D.H. Enterprises India, and Bros Entertainment Shoppe, though the exact amounts for these accounts have not been made public.

This auction comes close on the heels of a much larger sale attempt by PNB in late December. On December 27, the bank had invited bids for bad loans worth around ₹2,500 crore. That portfolio included well-known stressed accounts such as Millennium Expressway, Aban Offshore, Gupta Power and Infrastructure, and Moser Baer, along with around 20 other corporate borrowers. The total value of that auction stood at about ₹2,560 crore.

In recent years, banks have mostly focused on selling retail and microfinance bad loans, making PNB’s move to auction large corporate accounts relatively uncommon. This signals a clear shift in strategy, with the bank now directly addressing stress in its corporate loan book.

Earlier, in an interview in August, PNB Managing Director and CEO Ashok Chandra had said the bank had identified more than 100 bad loan accounts worth ₹4,000 to ₹5,000 crore for sale. He had also expressed confidence in recovery, saying the bank expects to recover at least 40–50% from these transactions.

The current auction underlines PNB’s proactive approach to resolving bad loans. By partnering with asset reconstruction companies and pushing ahead with large corporate NPA sales, the bank is aiming for faster clean-up and a stronger balance sheet going forward.