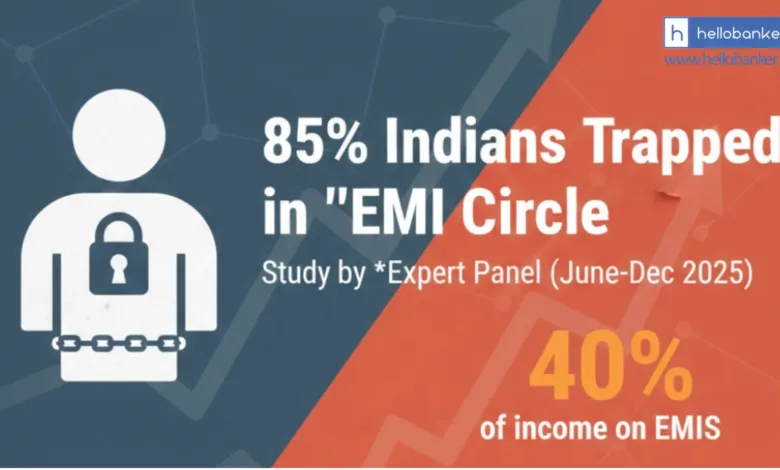

Is India Living on EMI? India’s Credit Crisis Deepens: 85% Borrowers Spend Over 40% Income on EMIs

A recent study by Expert Panel, a debt resolution firm, has revealed a serious financial problem faced by many Indians. According to the study, 85 percent of borrowers are spending more than 40 percent of their monthly income only on EMIs. The survey was conducted between June and December 2025 and included 10,000 financially stressed borrowers from different parts of India.

Spending such a large part of income on EMIs means that many people are left with very little money for daily expenses like food, education, healthcare, and emergencies. In many cases, borrowers take new loans just to manage old EMIs, which increases their debt further. This creates a cycle where people keep paying loans but are unable to come out of debt.

The study shows that easy access to loans, rising cost of living, and slow income growth have pushed many families into this situation. While loans were meant to help people buy homes, vehicles, or meet personal needs, they are now becoming a burden. For many borrowers, EMIs have turned into a permanent monthly pressure rather than a temporary financial support.

This situation suggests that a large number of Indians are trapped in an “EMI circle”, where most of their income goes towards loan repayments. Without better financial planning, controlled borrowing, and support for debt management, this problem could worsen and affect household stability and overall economic well-being.

Easy credit options like buy now, pay later schemes, instant loan apps, personal loans, and credit cards are pushing people into a dangerous debt trap. What starts as a genuine need slowly turns into borrowing more money just to pay old EMIs.

EMIs Eating Up Salaries

Most borrowers earn between ₹35,000 and ₹65,000 per month, but their monthly EMIs range from ₹28,000 to ₹52,000. This leaves very little money for basic needs like food, rent, education, and medical expenses. Experts recommend EMIs should not cross 30 percent of income, but for most people in this survey, the burden is far higher.

Who Is Struggling the Most?

The majority of affected borrowers work in private sector jobs (61%), followed by small business owners (23%) and even the unemployed (15%). Many have 4 to 6 active loans at the same time, taken from banks, NBFCs, and digital lending apps. Credit card debt is another big problem. Around 65 percent of borrowers have credit card dues, often between ₹2 to ₹4 lakh, and more than half own multiple credit cards.

Why People Fall Into Debt

The survey shows that debt stress often starts with life events:

- Job loss, salary cuts, delayed payments, or maternity leave (28%)

- Medical emergencies (24%)

- Business losses (22%)

- Family responsibilities (18%)

- Investment losses (8%)

Once income is disturbed, people borrow again just to stay afloat, creating a never-ending debt cycle.

Desperate Ways to Survive

To manage EMIs, borrowers are taking extreme steps:

- Taking new loans or rotating credit cards (40%)

- Taking help from family (22%)

- Salary advances (16%)

- Selling assets like gold, shares, or even property (15%)

Shockingly, 65 percent cut essential spending, including food, healthcare, education, and insurance. These methods offer relief for just 2 to 6 months, but later make the situation worse due to higher interest and loss of assets.

Loan Recovery Harassment on the Rise

The situation becomes even more painful during loan recovery. Around 72 percent of borrowers reported harassment by recovery agents. Many receive 50 to 100 abusive calls every month, often early in the morning or late at night, which is against RBI rules.

Some borrowers reported:

- Threatening calls and messages on WhatsApp and SMS

- Calls to family members and references

- Visits to homes and workplaces

- Public humiliation and pressure on managers

Most victims are not aware of their rights or complaint options like the Banking Ombudsman, which makes them easy targets.

A Warning Sign for India’s Economy

India’s credit boom is now turning into a debt distress epidemic. This crisis is not because people are careless, but due to aggressive lending, easy digital loans, and sudden economic shocks. With 85 percent of borrowers overwhelmed by EMIs, the message is clear: urgent reforms are needed. Without action, this silent credit crisis could grow into a much bigger financial problem.