Interest Rates may be reduced Further this year by RBI: Bank of Baroda

| ➡️ Get instant news updates on Whatsapp. Click here to join our Whatsapp Group. |

Recently, the RBI has decreased the repo rate by 25 basis points. This is further expected to decrease the interest rates of loans by Banks. But there is one more big News related to this.

The Reserve Bank of India (RBI) may reduce interest rates further by 50 basis points (bps) in 2025 and shift its monetary policy stance from “neutral” to “accommodative,” according to a report by Bank of Baroda.

More Rate Cuts Expected

The report suggests that the RBI has entered a rate-cut cycle, with more reductions expected in the coming months. However, the exact timing of these cuts remains uncertain.

“As RBI embarks on the rate cut cycle, it can be expected that more cuts are also on the cards. While the timing is debatable, we are factoring in a total 75 bps cut in this calendar year,” the report stated.

Recent Rate Cut and Monetary Policy Stance

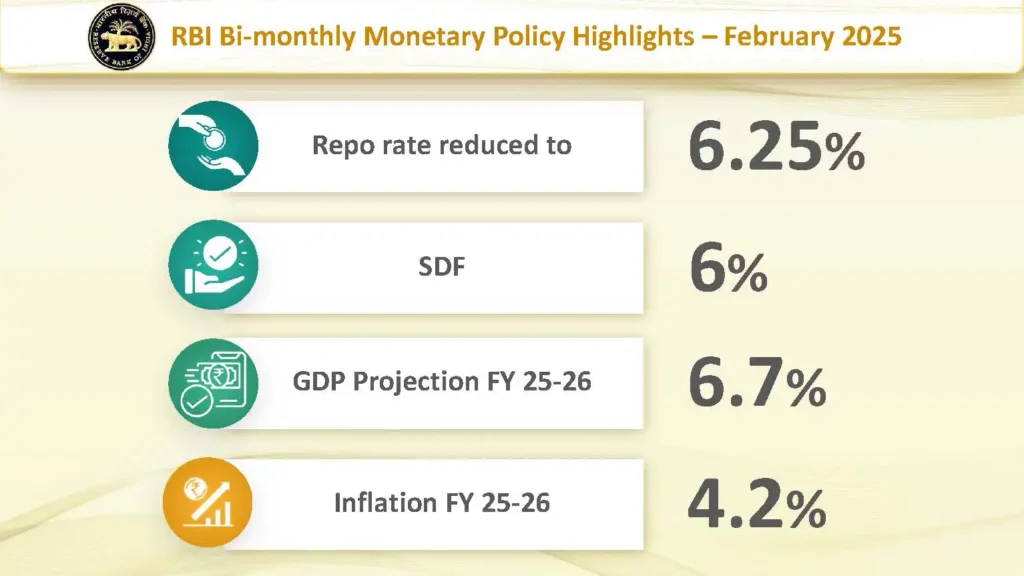

Earlier, the RBI reduced the repo rate by 25 bps to 6.25%, marking the first rate cut in five years. The Monetary Policy Committee (MPC) unanimously decided on this cut, also lowering the Standing Deposit Facility (SDF) rate to 6% and the Marginal Standing Facility (MSF) rate to 6.5%. Despite this reduction, the central bank maintained a “neutral” stance on monetary policy.

Inflation and Economic Outlook

The report projects a total rate cut of 75 bps in 2025, with the next monetary policy review in April playing a crucial role in determining further reductions or a policy shift.

It also highlights that inflation is expected to remain at 4.4% in the fourth quarter of FY25 and 4.5% in the first quarter of FY26. However, inflationary pressures are expected to ease from the second quarter of FY26 onwards, creating more room for additional rate cuts.

The report notes that rupee volatility has already been factored into these projections. With inflation expected to decline from mid-2025, the RBI is likely to cut rates further to support economic growth.

Shift to Accommodative Stance Likely

As the RBI implements further rate cuts, its monetary policy stance is also expected to shift from “neutral” to “accommodative.” This would signal a stronger focus on economic growth, making borrowing cheaper for businesses and consumers. Lower interest rates encourage investment and spending, boosting overall economic activity.

This is the first rate cut by the RBI since the COVID-19 period, reflecting a monetary policy shift to support economic recovery.

April Monetary Policy Review Crucial

The upcoming April monetary policy meeting will be a key moment for the RBI, as policymakers closely monitor inflation and growth trends. The decision taken in this review will determine whether another rate cut or a change in policy stance is on the horizon.