India’s 3rd Largest PSU Bank, Rs.18,000 crore Net Profit BUT No Peons in Branches

In every government department, peons play a very important role. While many people think they only carry files, their responsibilities go far beyond that. Peons help in dispatching letters and documents, handling day-to-day paperwork, and keeping the department running smoothly. Without them, even small administrative tasks can get delayed.

Now let’s talk about banks—especially public sector banks. Here too, peons are a vital part of branch operations. You may be surprised to know that peons in banks handle important tasks related to financial records. Every financial transaction in a bank generates a voucher or document, and these documents need to be properly maintained and stored for at least 10 years as per the Reserve Bank of India (RBI) guidelines.

These vouchers are extremely important. If a customer has a complaint or a case goes to court, the bank must provide the related documents. It is the peons who manage these files and ensure they are kept safe and organized. So, if peons are not available, how will these important records be managed?

Surprisingly, while there is a lot of discussion about the shortage of bank officers and clerks, no one is talking about the shortage of peons. Many bank branches across the country are struggling due to a lack of peons. Without them, basic functions like handling physical vouchers, cleaning, and internal document movement suffer badly.

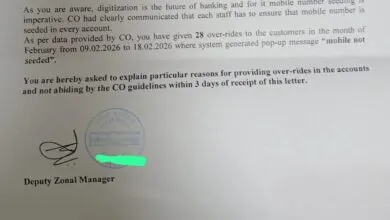

One of India’s largest public sector banks, Punjab National Bank (PNB), is currently facing a serious staff shortage. The issue is not just about officers and clerks—even peon posts are vacant. Despite the growing workload and the importance of maintaining records, banks are not recruiting peons.

Net profit of Punjab National Bank had increased 49.28% to Rs 4989.29 crore in the quarter ended March 2025. For the full year, PNB reported net profit of Rs 18480.29 crore. This is huge profit and Bank can easily hire more staff to improve its customer service.

Recently, only Bank of Baroda announced a recruitment drive for peons. No other major bank has followed. This shows a clear lack of attention from bank management toward the issue.

Who Will Be Responsible If Records Go Missing?

This situation raises a critical question: If any voucher or important record goes missing, who will be held responsible?

- Will it be the branch manager or officer, who already has multiple responsibilities?

- Or should the senior management be held accountable for not hiring enough support staff?

There are reports that a lot of branches of public sector banks including PNB are running without Peons. Branches have hired private individuals on daily salary basis or monthly salary basis to do the work of Peon. But the big question is – Can a private individual be trusted with financial work? Why Banks are not hiring Peons?

This is not just a staffing issue—it is about the security and integrity of customer records. Missing documents can lead to serious legal troubles for both the bank and its customers.

Bank employees’ unions should raise their voice and demand immediate recruitment of peons. Ignoring the shortage now may lead to bigger problems in the future, especially when legal or regulatory bodies ask for documents that the banks fail to produce.