Govt planning to divest upto 3% stake in Indian Overseas Bank

The Central Government is planning to divest up to 3% stake in Indian Overseas Bank (IOB) through an offer for sale (OFS). OFS will open on Wednesday, December 17. The government plans to offload up to a 2% stake, or 38,51,31,796 equity shares, on Wednesday through the non-retail window. The broker to the offer is Goldman Sachs (India) Securities Private Limited.

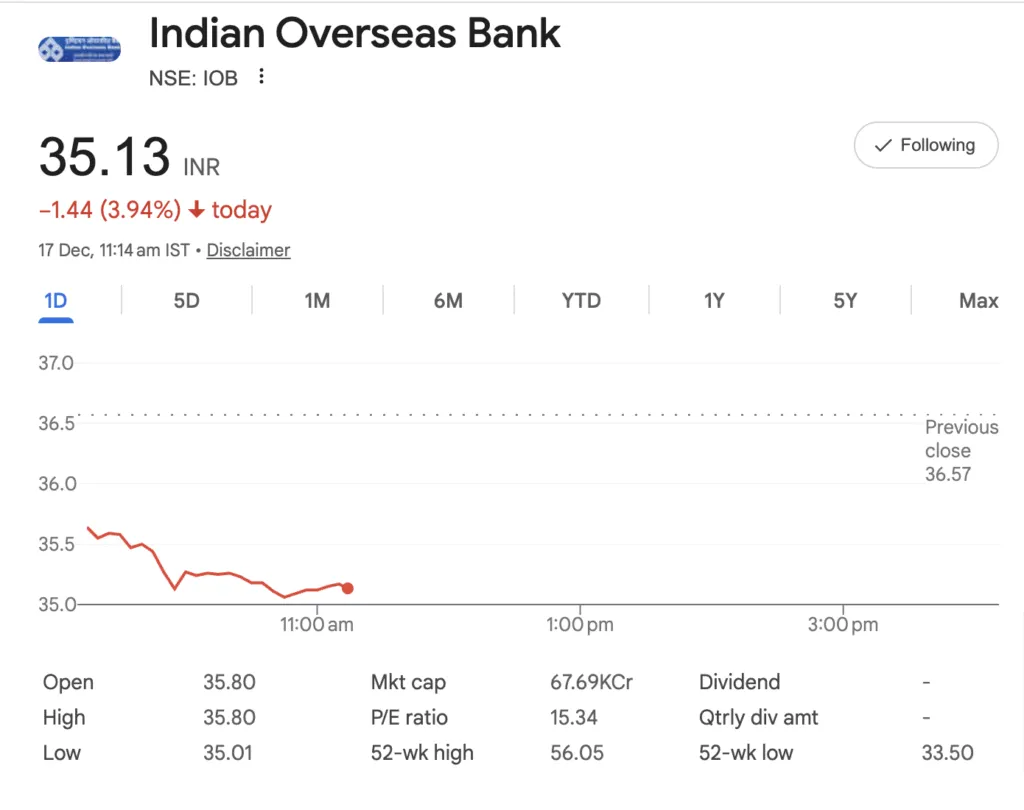

The shares of Indian Overseas Bank also fell by 4% today.

The OFS will open for retail investors on Thursday, December 18, with the government retaining the option to sell an additional 1% stake, or 19,25,65,898 shares, via a green shoe option through a separate designated window.

The floor price has been set at Rs 34 per equity share and the offer will take place during trading hours and orders can be placed on the BSE and the NSE. At the floor price, the OFS size is worth over Rs 1,964 crore. The floor price is at a 7% discount over today’s closing price of Rs 36.55 on the NSE.

What is Offer for Sale (OFS)?

Offer for Sale (OFS) is a method through which promoters or major shareholders of a listed company sell their shares to the public on the stock exchange. OFS is a quick way for big shareholders to sell shares to the public. It does not dilute the company’s equity, and it helps maintain transparency in large share sales. It is commonly used when:

- The government wants to reduce its shareholding in public sector companies

- Large investors or promoters want to partially exit or reduce their stake

OFS allows selling shares in a transparent, efficient, and fast manner through the stock exchange platform.

Key Points About OFS

1. Only Promoters or Big Shareholders Can Use It

OFS can be used only by:

- Promoters

- Promoter groups

- Large non-promoter shareholders (holding at least 10%)

Retail investors, mutual funds, and others can buy through OFS but cannot sell through OFS.

2. Shares Are Sold Through the Stock Exchange

OFS happens on:

- NSE

- BSE

It usually takes place over one trading day, making it quicker than an IPO or FPO.

3. A Discount Is Often Offered

Companies often offer a discount to retail investors to encourage participation.

4. Used for Government Disinvestment

The Indian government frequently uses OFS to sell shares in PSUs like:

- Coal India

- ONGC

- SBI

- LIC

This helps it raise funds without issuing new shares.

How OFS Works (Simple Steps)

- Promoter announces that they want to sell a certain number of shares.

- Stock exchanges notify the market about the OFS date and details.

- Investors place bids during market hours.

- Shares are allotted to successful bidders at the cut-off price.

- Money is debited and shares are credited to the demat account.

Difference Between OFS and IPO

| IPO | OFS |

|---|---|

| Company issues new shares | Promoters sell existing shares |

| Increases share capital | No change in share capital |

| Complex, time-consuming | Simple, 1-day process |