Govt Bank Employees are getting Negative Salary, But Why?

| ➡️ Get instant news updates on Whatsapp. Click here to join our Whatsapp Group. |

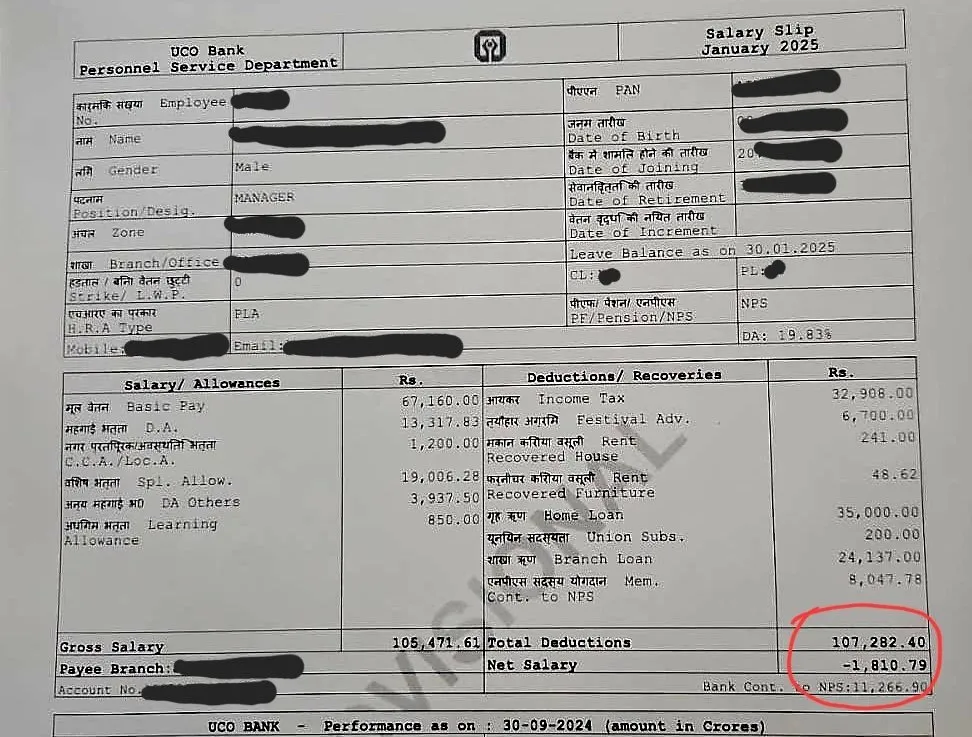

The government bank employees are receiving salary in negative this month. This might seem to be a little weird but this is happening. Check salary slip given below. The below salary slip is of a Manager working in UCO Bank.

As you can see in salary slip, the net salary is in negative. The net salary is -1810.79 rupees. This is so because the banks have been asked to deduct Tax on perquisites from the salary of employees. What this means?

Bank Employees get some job benefits such as loans on low rate of interest. For example – Rate of interest for Car Loan for normal public is 9%. Bank Employees get loan at 5.5%. As the rate of interest is low for Bank Employees, they are able to save some money in loan and this is counted as Perquisite. Now, Bank Employees have been ordered to pay tax on this Perquisite. This means that tax will be paid on the difference in amount due to difference in Rate of Interest. In case of car loan, if normal public pays Rs.1000 interest but Bank Employees pay Rs.700 interest, then Bank Employees need to pay tax on difference amount i.e.Rs.300.

Some Banks such as SBI and Bank of Baroda have agreed to pay this tax on behalf of their staff. This means that SBI and Bank of Baroda employees need not pay Tax on perquisites from their own salary slips. This is a highly motivating decision from both the big public sector banks in India. But other public sector banks have asked their employees to pay the tax.

This is totally demotivating as loans at low interest rate was a big perk offered to Bank Employees. The allowances and job benefits offered to Bank Employees are less as compared to other government jobs. Other government departments also offer a lot of benefits to their employees but right now, only banks have been asked to collect tax from their employees.

Either the government should remove this Tax liability on perquisites for Bank Employees or Banks should pay the Tax on behalf of employees. If this is not done, then it’s expected that it might lead to loss of talent for banking sector in India. Banking Job may become less attractive for youth and they might search other jobs with lucrative offers and perks.

Even SBI employees also paying this tax

The remuneration they get is nothing when compared to their output. Nowadays made accountable for NPA accounts they face hard times.. In case of frauds committed by borrowers they become victims unwittingly. Too bad.

Book the fraudster auction his property and send him to jail.

Even sbi is collecting tax on perquisites

Bardast kr rhe h sab tabhi to ulte sidhe decision thop rhe h … Shame on union leader…

Some fake info . SBI is not paying loan perquisite tax on behalf of employees

Government is doing everything through every agencies for privatization of Public sector Banks.

गए थे हरी भजन को

ओटन लगे कपास

Previous TDS deduction by the bank is pending otherwise salary never in negative

Jin bureaucrats ne ye tax bank walo ke upar court dwara lagwaya hai kya ye log koi govt benefits nahi le rahe hai, yadi haan to ye sab unki salary se vasool Kiya jaay.

Why only bank employees?? Whether all other government employees have got any kind of exemption from perquisite tax being imposed on them also?? Where are employees’ unions now?? Will they not save their members’ lives??. How an employee and his family will survive a single day of month with no salary, meagre salary Or negative salary?? Whether the government or employers have sanctioned some sort of relief like free food, water, cloths, free shelter, free schooling to children of bank employees, free medical aid, free traveling, free gas cylinder, free electricity, waiver of credit card outstandings, payment of insurance premiums etc. while calling for complete deduction of salary in the name of tax on so called benefit???

Whether the so called concessional loans will remain as benefit any more if the same are considered as taxable income?? What is the meaning of claiming the home loan emi as an option for getting tax relief??

Whether the complete deduction of salaries are justified??