Former MLA accuses Fraud by Axis Bank in Lucknow, files complaint to CM Yogi

| ➡️ Get instant news updates on Whatsapp. Click here to join our Whatsapp Group. |

Former MLA Brijesh Mishra has accused Axis Bank in Lucknow of committing fraud. He claims that the bank provided a loan of Rs 20 lakh against his shares but withheld shares worth Rs 46 lakh without informing him.

When Mishra asked the bank agent to close the loan, the agent refused. Attempts to get information from bank officials were futile as no one answered his calls. Mishra has now filed a complaint with the Lucknow Police Commissioner.

Brijesh Mishra, also known as ‘Saurabh,’ is a resident of Pratapgarh and served as an MLA from the Gadwara assembly seat in 2007. He currently lives with his family in Paper Mill Colony, Lucknow. He opened an account at Axis Bank’s Raj Bhavan branch five years ago.

He invested Rs 80 lakh in the stock market through the bank branch, and with interest, the amount grew to Rs 1.03 crore. Axis Bank agent Atul Pandey frequently called him, offering loans against his shares. Despite initially refusing several times due to lack of need, Mishra took a loan of Rs 20 lakh from the bank in February 2024. He was paying the monthly installments, sometimes with a penalty for late payments.

On July 26, Mishra called Pandey to close the loan by selling his shares. However, Pandey refused to close the loan. When Mishra visited the bank for more information, he discovered that the bank had blocked Rs 46 lakh worth of shares against the Rs 20 lakh loan. This amount was neither being invested in the stock market nor earning any interest.

Mishra was asked to fill out a form and was assured that the money would be released the next day after the market opened. However, the process did not happen as promised. When Mishra called Pandey again, Pandey started procrastinating and eventually stopped answering calls. After pressing the issue, Mishra was connected to Gaurav Shukla on a conference call.

Shukla mentioned calculating stamp duty and warned about potential market crashes that could cause losses. Shukla’s dismissive attitude angered Mishra, who was told to do whatever he wanted.

Mishra visited Axis Bank’s office and spoke to senior officials, but his money was still not released. He alleges that Axis Bank is committing similar frauds against many account holders under the protection of their circle head, Shrikesh. Agents mislead customers into taking various loans and then intentionally delay closing the loans, thereby engaging in fraudulent activities.

Mishra also mentioned that the bank claimed he had digitally accepted all offers. His investment of Rs 80 lakh had grown to Rs 1.03 crore but dropped because the shares weren’t sold. The bank recalculated this amount to Rs 57 lakh. Despite taking a Rs 20 lakh loan in February, the bank blocked Rs 46 lakh worth of shares without informing him.

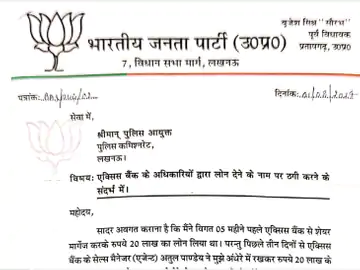

Mishra has been making rounds of the bank for five days due to these calculations. When he mentioned filing a complaint, bank officials told him to do whatever he wanted. Brijesh Mishra has also written a letter to Chief Minister Yogi Adityanath and Lucknow Police Commissioner Amarendra Bahadur Singh about the issue.

Private Banks are not responding properly. Jio payment bank is not providing contact numbers and addresses of top officials to get resolution if resolved at lower level.