Finance Minister Nirmala Sitharaman conducted Review Meeting of RRBs in South India, Check Meeting Highlights

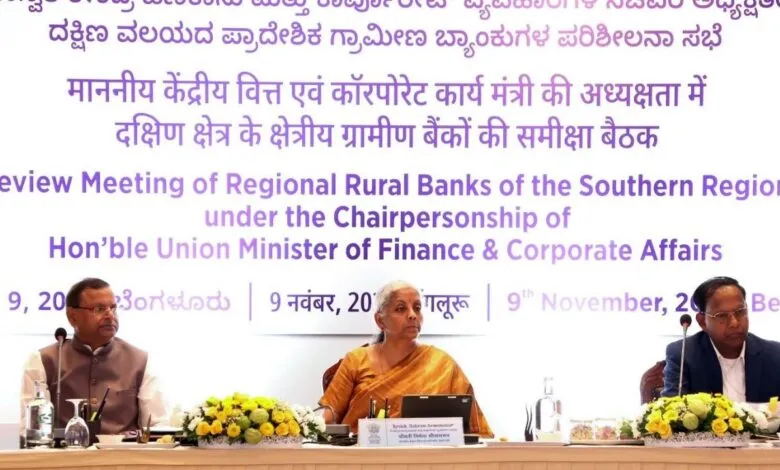

Review Meeting of RRBs in South India: Union Finance and Corporate Affairs Minister Nirmala Sitharaman led a review meeting today in Bengaluru to assess the performance of 10 Regional Rural Banks (RRBs) across the southern states—Andhra Pradesh, Karnataka, Kerala, Tamil Nadu, Telangana, and the Union Territory of Puducherry. The meeting included Union Minister of State for Finance Pankaj Chaudhary, Department of Financial Services Secretary M. Nagaraju, RBI Executive Directors, RRB and sponsor bank chairpersons, and representatives from NABARD and SIDBI.

Emphasis on Business Growth and Digital Upgrades

The meeting centered on bolstering business growth, advancing digital services, and enhancing support for agriculture and MSME sectors. Finance Minister Sitharaman urged the RRBs to boost credit distribution under major government schemes like MUDRA and PM Vishwakarma, with active participation from their sponsor banks.

Strengthening Agriculture Credit with Focus on Allied Sectors

Sitharaman directed RRBs to expand their share in agriculture credit, especially for allied sectors such as dairy, animal husbandry, and fisheries. Specific directives were given to increase credit for the fisheries sector in Kerala and dairying in Telangana. This focus aims to unlock the full potential of agriculture-based activities in the region.

Commendation on Financial Performance

Acknowledging the financial progress of RRBs since the 2022 review initiative, Sitharaman highlighted the RRBs’ consolidated profit of Rs. 3,816 crore for FY 2024, accounting for over half of the net profit across all RRBs. The southern region RRBs have maintained a healthy CRAR of 17.6% and a GNPA rate of 3.94%.

CASA Deposits and Financial Inclusion Goals

The Finance Minister emphasized mobilizing Current Account Savings Account (CASA) deposits to sustain credit growth. Minister Pankaj Chaudhary urged RRBs to fulfill targets under financial inclusion schemes such as PMJDY, PMJJBY, PMSBY, and APY. Sitharaman also instructed sponsor banks and RRBs to launch a drive to operationalize dormant PMJDY accounts.

Customized MSME Credit and Digital Customer Onboarding

Sitharaman directed RRBs to develop customized MSME credit products aligned with regional cluster activities and to streamline customer onboarding through digital services. SIDBI and RRBs were asked to explore digital collaborations for co-lending, risk-sharing, and refinancing MSME portfolios.

Technological Advancements and Customer-Centric Services

The Minister praised RRBs for completing digital service upgrades, including Micro-ATMs, call centers, net banking, Video KYC, and real-time payment systems. She encouraged RRBs to promote these services among customers with the assistance of sponsor banks.

Recruitment Revisions and RRB Consolidation

The Finance Minister directed DFS to revise RRB recruitment rules to ensure candidates possess local language skills. Additionally, she called for feedback from state governments on a proposal to consolidate RRBs under a ‘One State-One RRB’ model.

The meeting underscored the critical role of RRBs in advancing rural credit, technology adoption, and financial inclusion across southern India.

Good initiative. But review of Deputed staff from sponsor bank may not help the better results of RRBs. These deputed staff taking anti RRB decisions causing migration of business to their parent bank. Fixing of accountability on these deputed staff only solve the issues pertaining to RRBs.

Sponsor banks deputing more than required strength to minimise the expenditure at their bank.

DFS MUST DIRECT SPONSOR BANK TO DEPUTE MINIMUM NUMBER OF IT’S STAFF AND INVOLVE RRB STAFF IN DECISION MAKING AND ADMINISTRATION.

Decision of DFS one State one RRB will be really a game changing in the Rural areas. As these are supposed to function on low cost model which lost its significance by paying salaries & allowances in line with Commercial banks. In order to recover the extra cost incurred by RRBs, the staff of RRBs need to focus more on increasing the business level on the similar lines to that of Commercial Banks. They need to focus on generating more non interest income, rather than focussing only on rural area