Depsite UPI Currency circulation remains high in India

UPI has been a hit in India, and now almost everyone in urban and metro cities uses UPI for daily payments. However, according to the SBI report, although UPI usage is high, the currency in circulation is also high.

Currency in circulation (CiC) in India has continued to rise and reached record high levels in late 2025 and early 2026. For the month ended January 2026, CiC stood at Rs 40 lakh crore, with a year-on-year growth of 11.1% compared to 5.3% last year. On an incremental basis (year to date), CiC has increased by Rs 2.76 lakh crore compared to Rs 88,517 crore in the same period last year, which is about 3.11 times higher.

Similarly, currency with the public (CWP), which makes up around 97.6% of CiC, also reached an all-time high of around Rs 39 lakh crore for the month ended January 2026, showing growth of 11.5% compared to 5.4% last year. Based on current trends, CWP is likely to surpass the post-pandemic FY21 incremental growth of Rs 4.6 lakh crore.

Interestingly, although the volume of cash in circulation has increased, the cash-to-GDP ratio has declined in recent years to 11% in FY26 from 14.4% in FY21. According to the estimated money demand model, the GDP coefficient is not significant, while UPI is significant. This suggests that although currency and GDP may move in the same direction, incremental GDP growth is now being financed less by cash and more through UPI transactions.

As per the latest RBI data, the currency in circulation (CiC) has reached an all-time high of around Rs 40.0 lakh crore for the fortnight ended 31 January 2026, with a growth of 11.1% year-on-year compared to 5.3% growth last year.

On an incremental basis (year to date), CiC has increased by Rs 2.76 lakh crore (7.4%) during April 2025 to January 2026, compared to last year’s growth of Rs 88,817 crore (2.5%).

Meanwhile, Reserve Money (M0) growth declined to 5.8% year-on-year from 3.5% last year, mainly due to the CRR cut which reduced the ‘Bankers Deposits with RBI’ component by Rs 1.86 lakh crore during April 2025 to 31 January 2026.

As currency with the public (CWP) accounts for around 97.6% of the currency in circulation (CiC), CWP also reached an all-time high of Rs 39 lakh crore for the fortnight ended 31 January 2026, with a year-on-year growth of 11.5% compared to 5.4% last year. The growth has continued on an upward trend since the end of October 2025.

Also Read: Salary of Clerk and Substaff of PSU Insurance Companies Hiked, Check Here!!

On a year-to-date basis, CWP increased by Rs 2.79 lakh crore (7.6%) during April 2025 to 31 January 2026, compared to last year’s year-to-date growth of only Rs 93,326 crore (2.7%) during the corresponding period.

Based on the current trend, it is expected that in FY26, CWP will surpass the FY21 incremental growth of Rs 4.6 lakh crore recorded during the post-Covid-19 pandemic period.

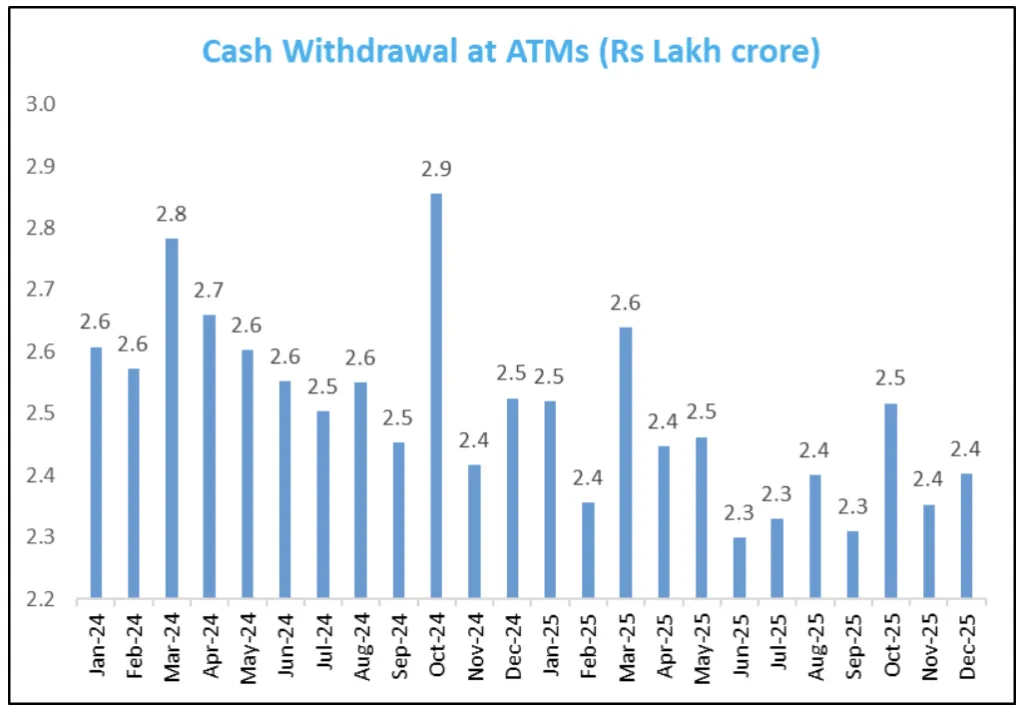

ATM usage

Despite the festive season in October 2025, cash withdrawal from ATMs has remained at the average level of Rs 2.5 lakh crore. It is interesting to note that during FY18 to FY25, the incremental average growth of currency with the public was also around Rs 2.5 lakh crore.

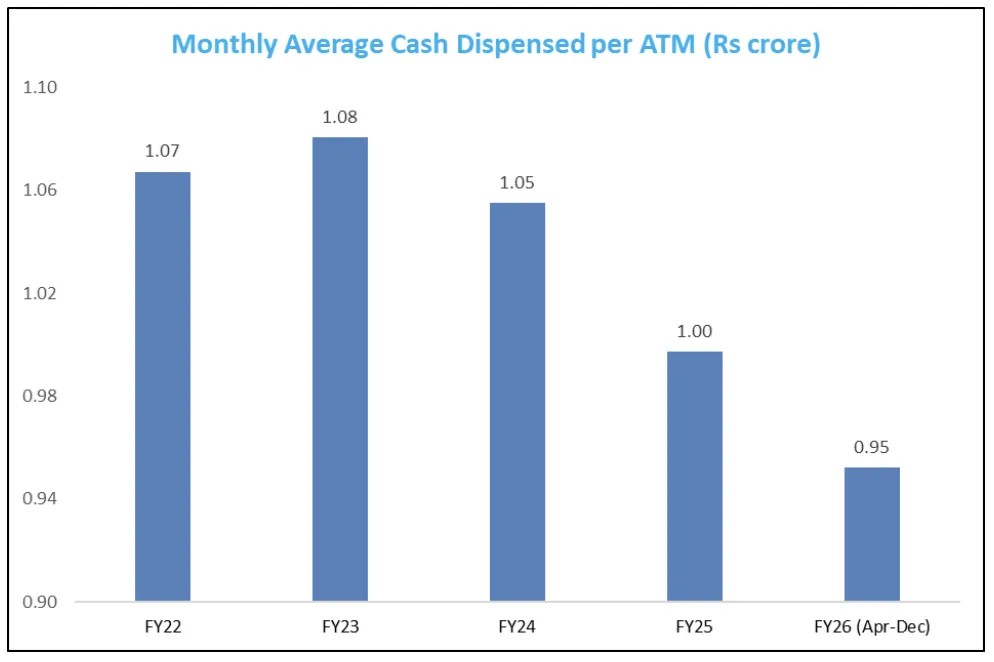

Monthly Average Cash Dispensed per ATM

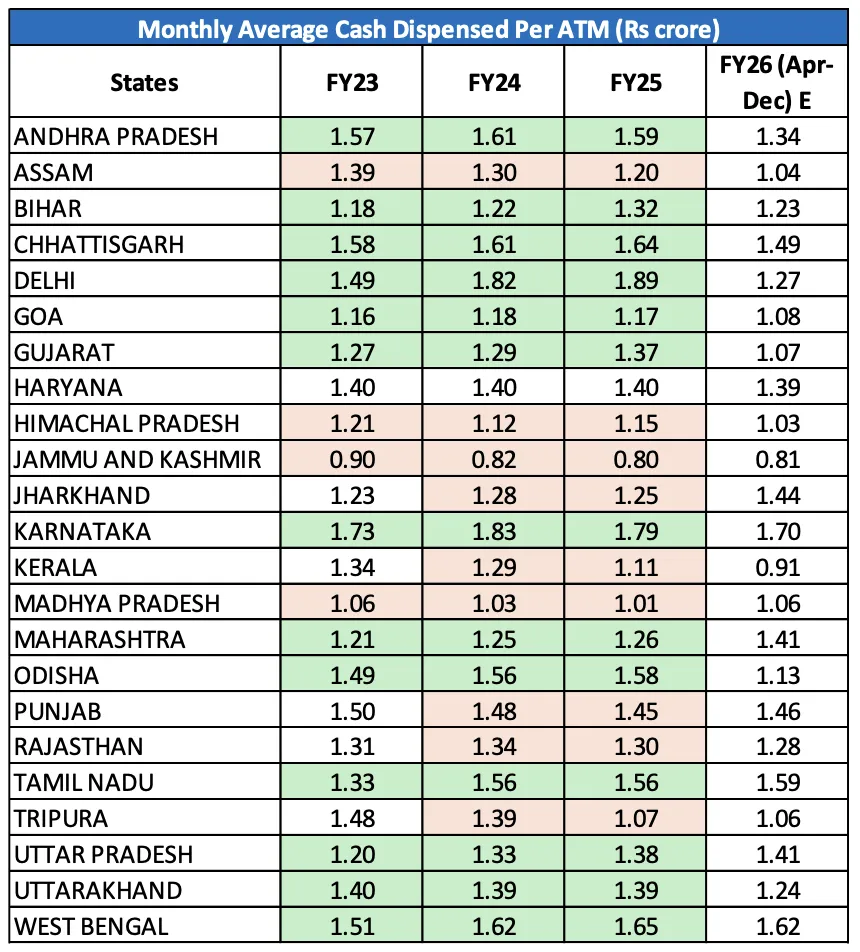

Monthly Average Cash Dispensed Per ATM State-Wise

Also Read: Female Bank Employee killed by Her Husband on suspicion of Extra-Marital Affair

Loading…

Loading…