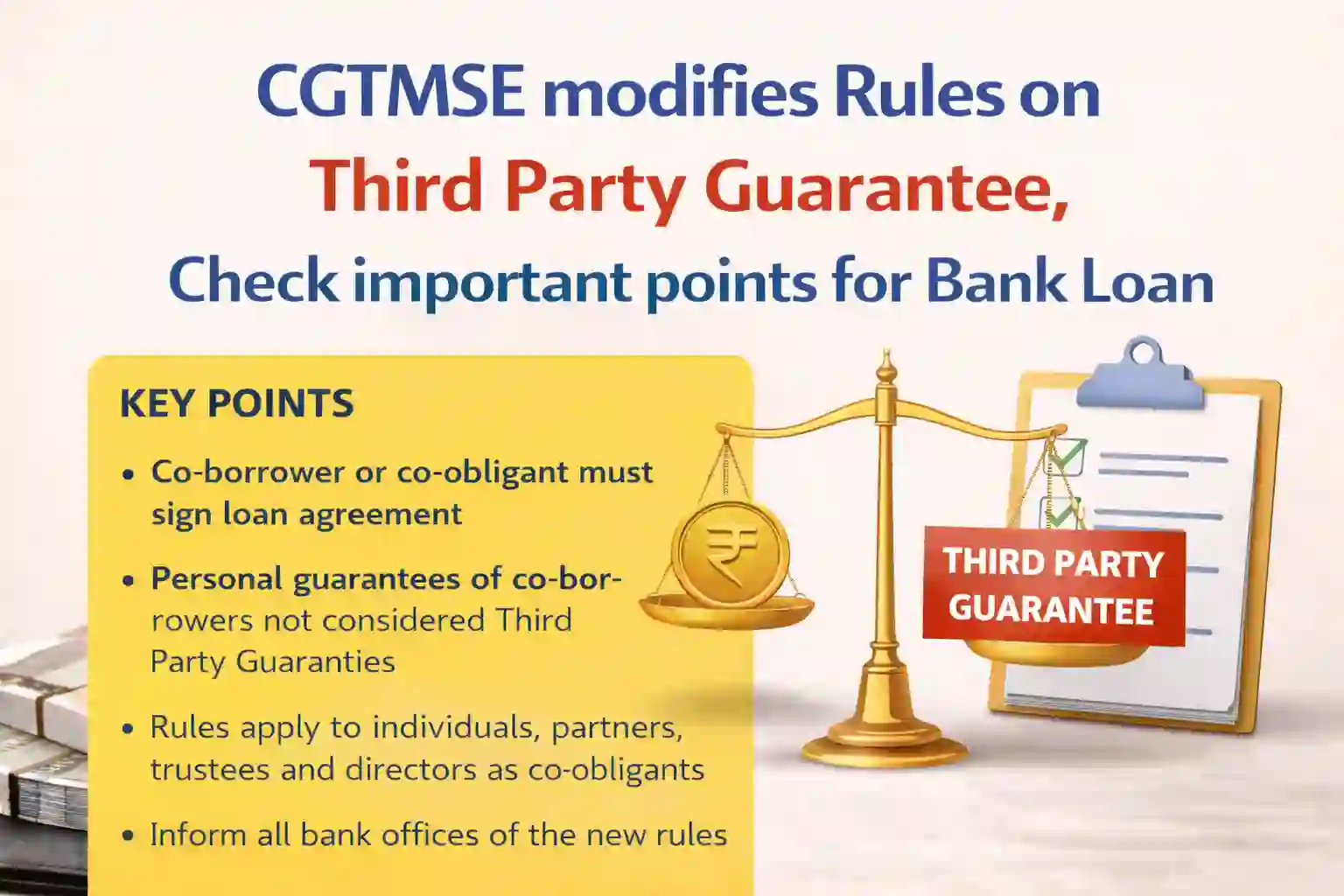

The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) has issued a new circular modifying the definition of “Third Party Guarantee” (TPG) under its Credit Guarantee Schemes for bank loans.

What Is the Change?

CGTMSE has reviewed the existing definition of Third Party Guarantee and made important clarifications.

As per earlier guidelines, a “Third Party Guarantee” means any guarantee obtained by a Member Lending Institution (MLI) in connection with a credit facility given to a borrower. However, certain guarantees were not treated as Third Party Guarantees. These included guarantees from:

- A sole proprietor in case of a sole proprietorship concern

- Partners in case of a partnership or Limited Liability Partnership (LLP) firm

- Trustees in case of a trust

- Karta and coparceners in case of a Hindu Undivided Family (HUF)

- Promoter directors in case of a private or public limited company

- Owner of collateral security under hybrid or partial collateral security model

New Clarification by CGTMSE

The matter has now been reviewed again. The circular states that wherever a co-obligant or co-borrower is a signatory to the loan agreement, certain personal guarantees will not be treated as Third Party Guarantees. These include personal guarantees of:

- A sole proprietor or individual acting as co-borrower or co-obligant

- Partners of the co-borrower or co-obligant partnership or LLP

- Trustees of the co-borrower or co-obligant trust

- Karta and coparceners of the co-borrower or co-obligant HUF

- Promoter directors of the co-borrower or co-obligant company

In such cases, these guarantees will not be considered Third Party Guarantees.