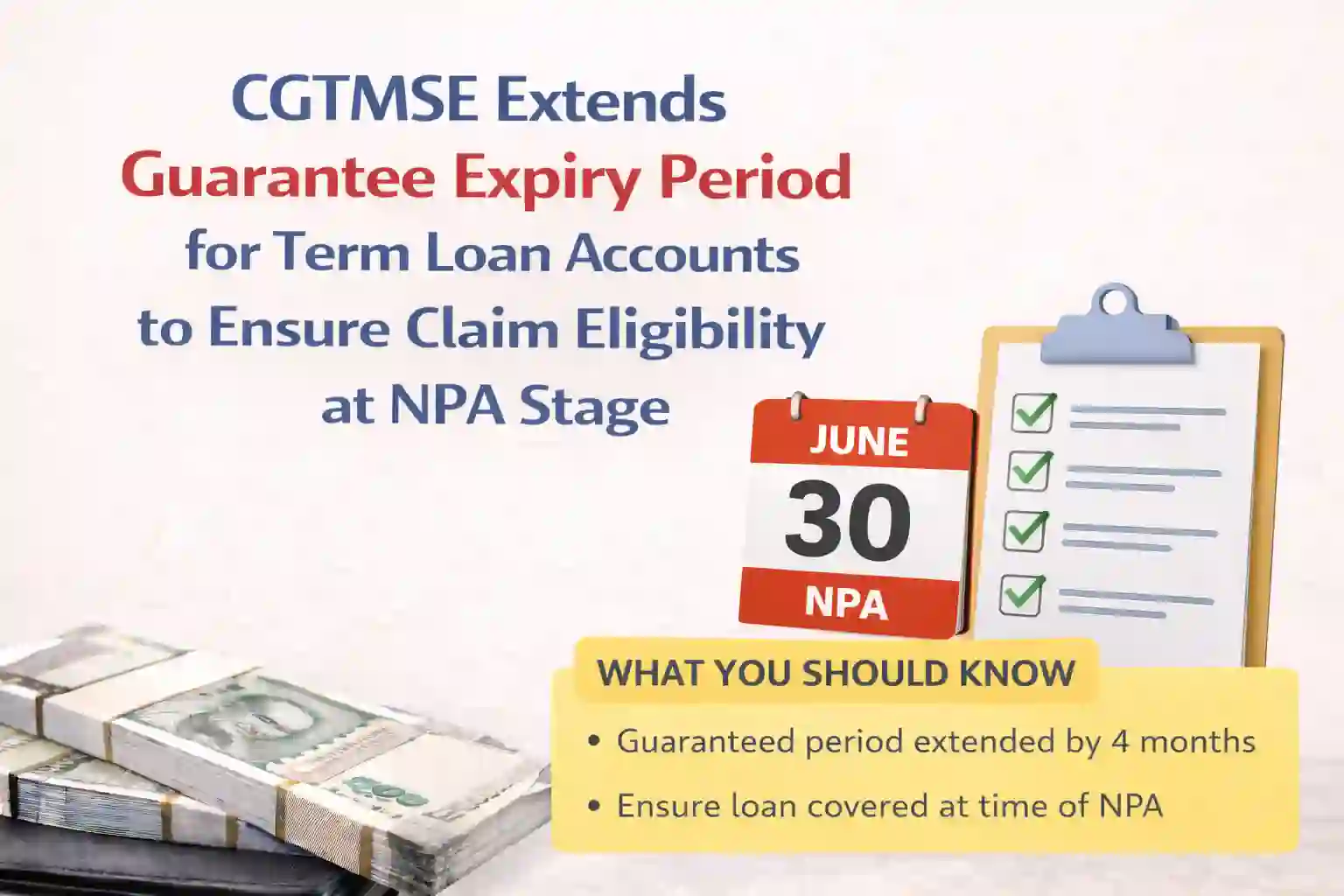

The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) has issued a new circular extending the guarantee expiry period for term loan accounts. The decision has been taken to ensure that loan accounts remain eligible for guarantee claims when they turn Non-Performing Assets (NPA).

Why Was This Decision Taken?

As per existing rules, the Annual Guarantee Fee (AGF) is charged up to the guarantee expiry date or closure of the account, whichever is earlier.

Further, as per Scheme Guidelines, the guarantee must be in force on the date the account turns NPA. This means that the loan account must be within the guarantee validity period on the NPA date for the lender to be eligible to file a claim.

However, CGTMSE observed a problem in certain cases. Especially when borrowers default on the last instalment(s), the account sometimes turns NPA after the original guarantee expiry date. In such situations, the loan becomes ineligible for guarantee claim.

Example Given in the Circular

The circular gives an example:

- A loan sanctioned on April 01, 2025 with a 5-year tenure

- The guarantee expires on March 31, 2030

- If the borrower defaults in the last instalment(s), the account may turn NPA during April–June 2030

- Since this is after the guarantee expiry date, the claim becomes ineligible

To avoid such situations and ensure seamless coverage at the time of NPA recognition, CGTMSE has made the following changes.

What Has Been Decided?

1. For New Guarantees Issued After the Date of the Circular

For all term loan accounts where guarantee is issued after the date of this circular, the guarantee expiry date will be:

Original expiry date + four (4) months

2. For Existing Live and Standard Guarantee Accounts

For all existing live and standard guarantee accounts:

- The guarantee expiry date will be extended by four (4) months

- This extension will apply uniformly to all live and standard CGPANs

- These accounts must not be marked as NPA in the CGTMSE portal

However, there is one exception:

- Cases where the guarantee expires in the current financial year (FY 2025–26) will not get the extension

- In these cases, the expiry date will remain unchanged

- This is because the guarantee fee for FY 2025–26 has already been paid

3. Annual Guarantee Fee (AGF)

AGF will be charged for the extended period.

This means:

- AGF will be charged for original expiry date + four (4) months

- This will apply to both new cases (after the circular date) and existing live and standard cases

What This Means for Banks

With this decision, banks will get an additional four months of guarantee coverage. This will help ensure that accounts turning NPA shortly after the original expiry date remain eligible for guarantee claims. The move is expected to provide better protection to lenders and avoid claim rejection due to technical expiry issues.