Banks hiring more Officers and fewer Clerks: RBI Data

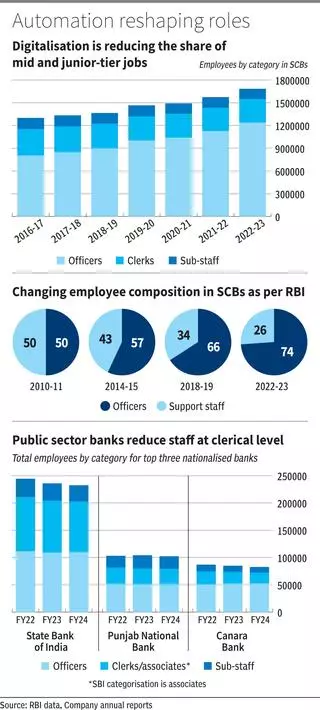

India’s banking sector, traditionally labour-intensive, is witnessing a transformation with digital technologies reshaping the composition of the banking workforce, particularly in nationalised banks. An analysis of the Reserve Bank of India (RBI) data on employees of Scheduled Commercial Banks (SCBs) reveals a significant trend: while the overall headcount has been steadily increasing, the growth primarily stems from hiring in the ‘officers’ cadre, whereas the number of juniors, including clerks, associates, and sub-staff, has been on the decline since at least FY17.

Shift in Employee Distribution

In FY17, the total employee count at India’s SCBs stood at 13 lakh, with 62% being officers (around 8 lakh) and the remaining 38% comprising junior staff (clerks and sub-staff). Over the years, the proportion of officers has been on the rise, and by FY23, officers constituted 74% of the workforce, with clerks making up just 26%. The RBI, in its recent Currency and Finance report, underscores this shift in the banking staff mix. In FY11, the ratio of officers to support staff was 50:50, which has gradually shifted to 74:26 in FY23.

Impact of Technology on Workforce Composition

Analysts and bankers point out that the adoption of technology for routine tasks such as Know Your Customer (KYC) and documentation has significantly impacted the workforce composition. This shift has led to a reduction in junior and middle-tier job roles and increased demand for analytical and supervisory senior staff. Balasundaram Athreya, President of Manipal Academy of BFSI, observes that while private sector banks continue to hire robustly, the evolution of core banking systems and front-end fintech innovations has led to a slowdown in hiring for junior roles. He notes that many private banks are establishing business intelligence units staffed by senior professionals, and the role of relationship managers has emerged as another key position requiring experienced staff. The Academy, on average, trains and sends around 10,000 freshers to the private banking sector annually.

Challenges for Nationalised Banks

The trend of workforce transformation is more pronounced in nationalised banks. Businessline’s analysis of bank annual reports reveals that nationalised banks face additional challenges in attracting junior talent compared to their private counterparts. For instance, the State Bank of India witnessed a 1.2% decrease in the headcount of officer staff from FY22 to FY24, but there was an almost 8% drop in the net headcount of clerks and sub-staff. Similarly, Canara Bank experienced a 3% increase in officer count from FY22 to FY24, accompanied by a 9% decrease in junior staff during the same period. The net headcount of employees at Punjab National Bank has remained relatively flat across FY22, FY23, and FY24.

Private Sector Banks and Contract Staffing

Unlike nationalised banks, private sector banks do not categorise their staff similarly in their annual reports. However, RBI data indicates a 16% growth rate in officer staff in the private sector, compared to a mere 3% increase in junior staff. Krishnendu Chatterjee, VP and Business Head (BFSI) at Teamlease Services, highlights that the banking sector has also seen a rise in contract staffing. He explains that while digitisation does not entirely eliminate the need for labour, banks are still hiring frontline sales, collections, and other staff through specialised subsidiaries established by large banks for operational support. For instance, SBI has an Outsourcing Services subsidiary named State Bank Operation Support Services (SBOSS), which handles these operations.