Banks can’t sell Properties at Low Price in Auction: High Court

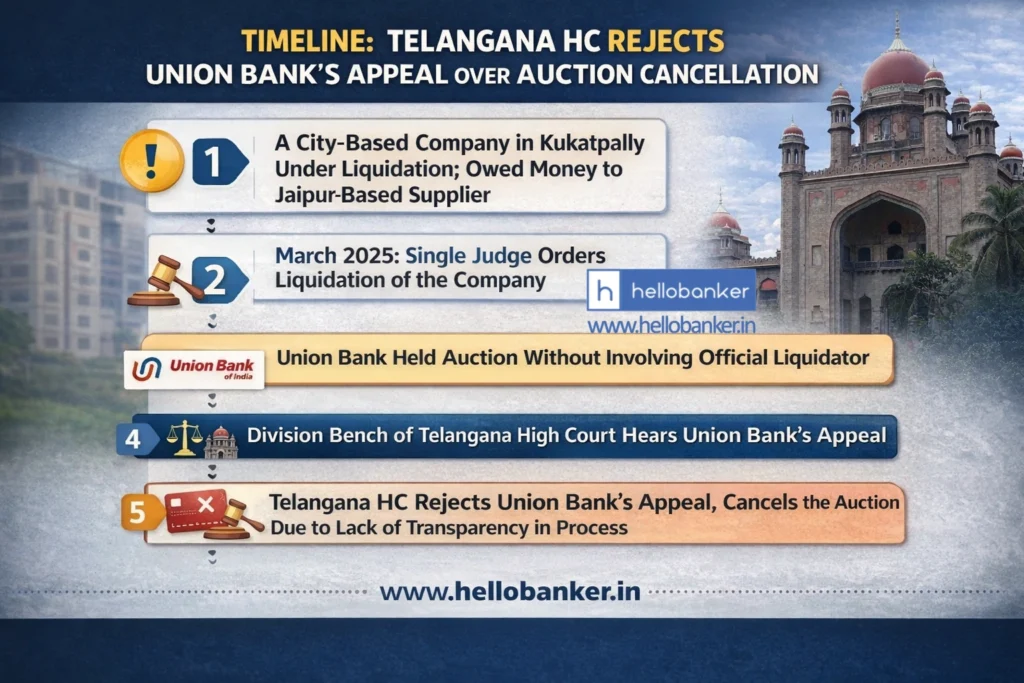

The Telangana High Court has rejected an appeal by Union Bank of India against the cancellation of an auction for a property belonging to a city-based company that was under liquidation, after finding that the bank did not follow proper legal procedures.

A division bench, comprising Justices K Lakshman and V Ramakrishna Reddy, stated that banks have the power to recover money through auctions; however, they must act with transparency and involve the official liquidator to ensure the property is sold for the best possible price. The bank had filed an appeal challenging a March 2025 order, in which a single judge ordered that the firm be wound up and its liquidation be completed.

The case stemmed from the defaulter firm located at Kukatpally owing money to a Jaipur-based material supplier as on May 2012 towards the supply of raw material in 2010. In view of the default of payment and the firm’s declaration that it has been going through a financial crisis, the single judge ordered the defaulter firm be wound up and liquidated.

However, since the firm was already auctioned by the bank towards recovery of loan dues, the bank moved an appeal. Hearing the appeal, the division bench observed that the firm’s former director had proposed a settlement and identified a buyer willing to pay over 32 crore for the property.

Despite this, the bank held its own online auction and sold the land for a much lower price of about 25.80 crore. Both the former director and the official liquidator objected, stating the bank ignored a higher offer and failed to include the liquidator in the process as required by law.

The high court ruled that banks must be transparent in their dealings. It noted that the liquidator represents the interests of all creditors and workers and must be involved in every step to ensure the highest sale price.

By failing to work with the liquidator and selling the asset for less money, the bank did not follow the necessary rules, the bench remarked, and it upheld the decision to cancel the auction and dismissed the bank’s appeal.

The Telangana High Court made it clear that while banks have the authority to recover their dues, they must strictly follow legal procedures and transparency. The court stressed that the involvement of the official liquidator is mandatory to protect the interests of all creditors and workers and to ensure that assets are sold at the highest possible value. By ignoring these requirements and proceeding with a lower-priced auction, Union Bank failed to comply with the law. The ruling reinforces the principle that recovery actions cannot override due process and accountability.