UK

Bank of England Capital Issuance – April 2025, Read Important Points

Connect with Us

The Bank of England has released Capital Issuance for the month of April 2025. The capital issuance statistics consist of non-government primary market issuance of bonds, commercial paper and equity, representing finance raised by UK resident entities.

Terminology

- PNFC = Private non-financial corporations

- MFI = Monetary financial institutions

- OFC = Other financial corporations

- “Other sectors” contains public corporations and non-profit institutions serving households

- CP = Commercial paper

Key points

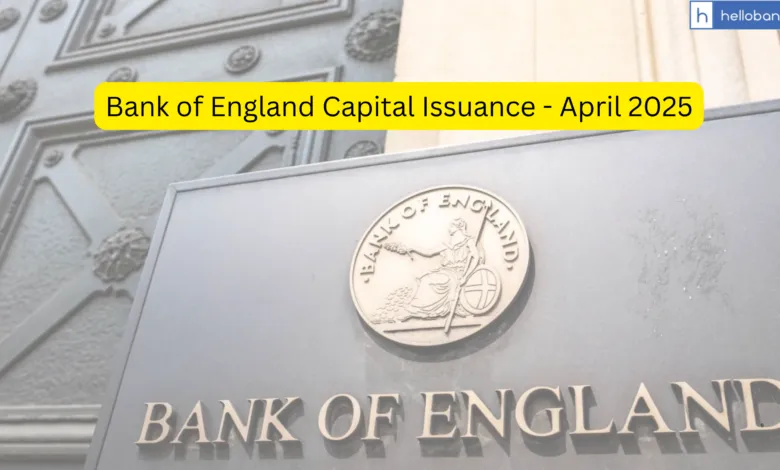

- Gross capital issuance by UK residents was £55.6 billion in April, compared to £63.2 billion in March and the previous six-month average of £59.4 billion (Chart 1).

- Net issuance was -£0.6 billion in April, compared to £1.7 billion in March and the previous six-month average of £2.3 billion (Chart 1).

- The fall in gross issuance was more than accounted for by a decrease in bond issuance of £16.4 billion, this was partially offset by a £8.6 billion increase in commercial paper issuance.

All sectors

- Gross capital issuance by UK residents was £55.6 billion in April, compared to £63.2 billion in March and the previous six-month average of £59.4 billion (Chart 1).

- Net issuance was -£0.6 billion in April, compared to £1.7 billion in March and the previous six-month average of £2.3 billion (Chart 1).

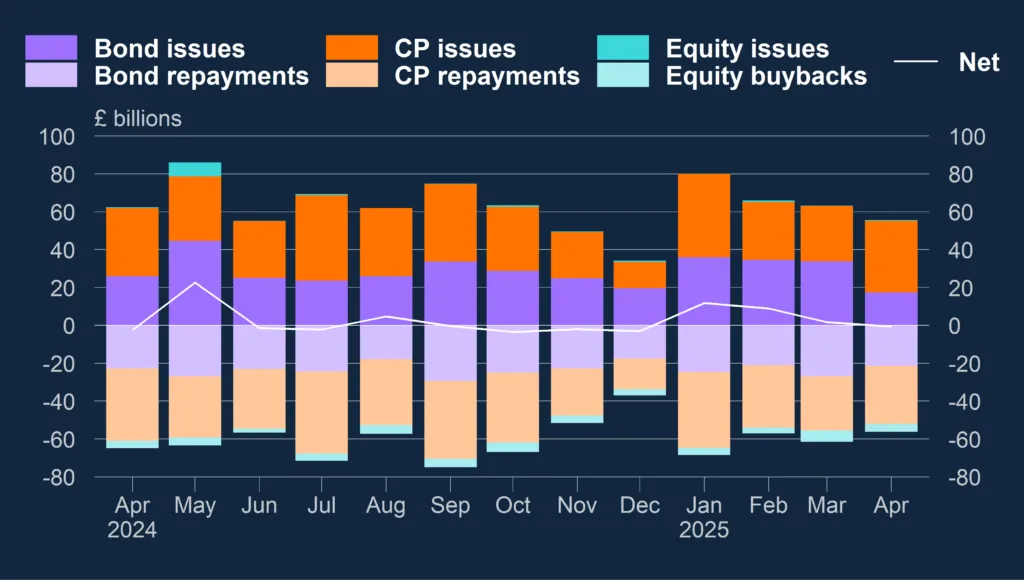

- Year to date gross issuance was £265.1 billion, £15.8 billion higher than at the same point the previous year (Chart 2) and £66.1 billion higher than the previous four-year average.

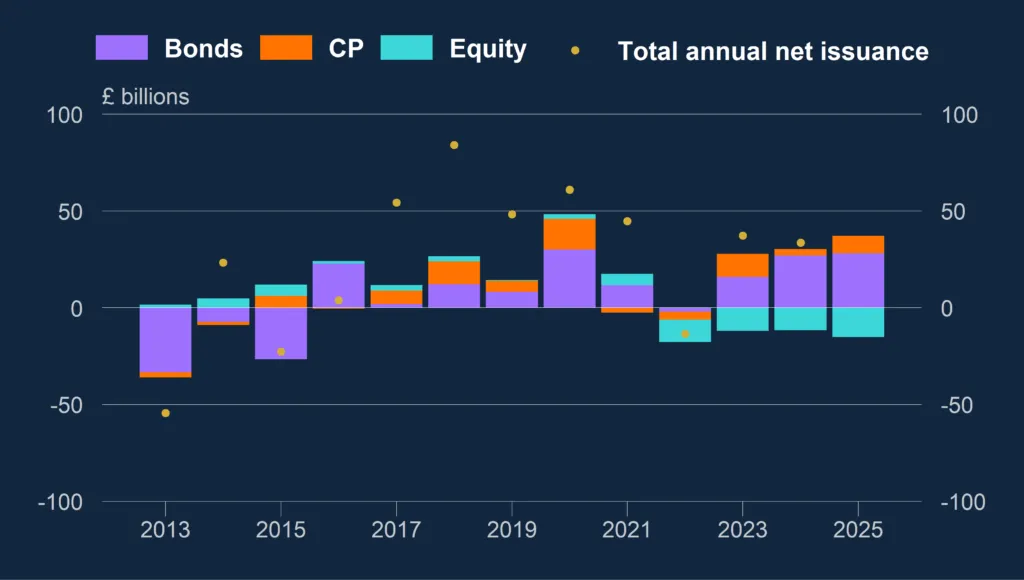

- Year to date net issuance was £21.9 billion, £3.2 billion higher than at the same point the previous year (Chart 3) and £14.0 billion higher than the previous four-year average.

Chart 1: Total capital issuance by UK residents (all currencies)

Non seasonally adjusted

Chart 2: Gross year to date capital issuance by UK residents (all currencies)

Non seasonally adjusted

Advertisement

Chart 3: Net year to date capital issuance by UK residents (all currencies)

Non seasonally adjusted

Bond issuance

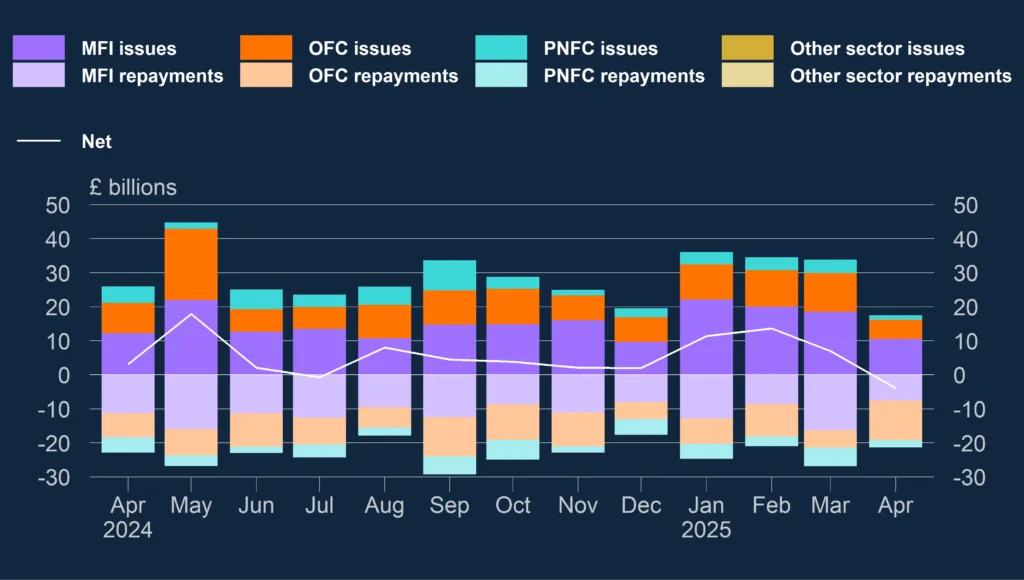

- Gross bond issuance was £17.5 billion in April, compared to £33.8 billion in March and the previous six-month average of £29.6 billion (Chart 4).

- Net bond issuance was -£3.9 billion in April, compared to £7.0 billion in March and the previous six-month average of £6.6 billion (Chart 4).

- The decrease in gross issuance was driven by falls in issuance of £7.9 billion and £5.9 billion by the MFI and OFC sectors respectively.

Chart 4: Bond issuance by UK residents (all currencies)

Non seasonally adjusted

Commercial paper issuance

- Gross commercial paper issuance was £37.8 billion in April, compared to £29.1 billion in March and the previous six-month average of £29.3 billion (Chart 5).

- Net commercial paper issuance was £7.1 billion in April, compared to £0.5 billion in March and the previous six-month average of -£0.6 billion (Chart 5).

- The rise in gross issuance was driven by increases in issuance of £5.0 billion and £2.6 billion by the MFI and OFC sectors respectively.

Chart 5: Commercial paper issuance by UK residents (all currencies)

Non seasonally adjusted

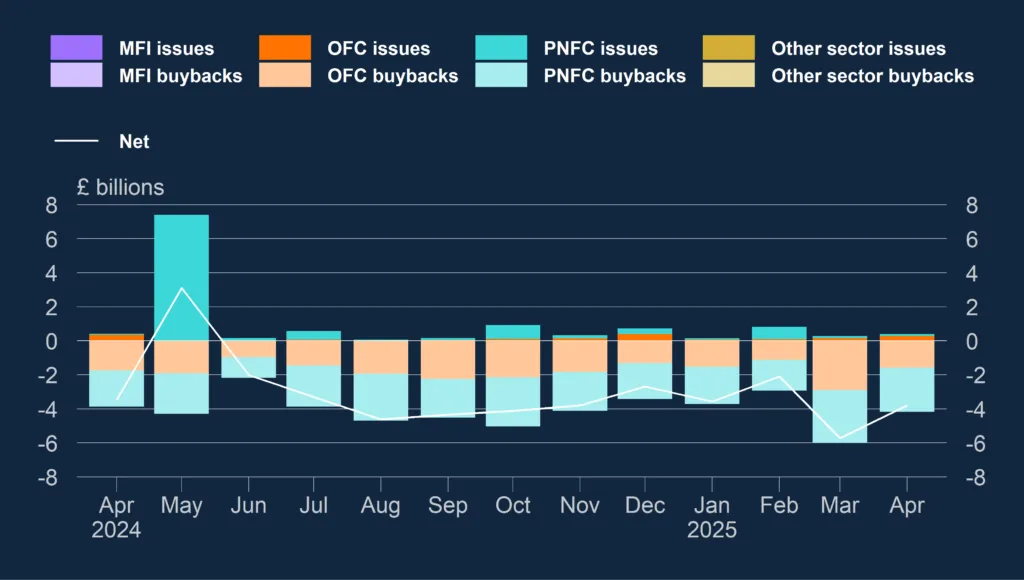

Equity issuance

- Gross equity issuance was £0.4 billion in April, compared to £0.3 billion in March and the previous six-month average of £0.5 billion (Chart 6).

- Net equity issuance was -£3.8 billion in April, compared to -£5.7 billion in March and the previous six-month average of -£3.7 billion (Chart 6).

- The increase in net issuance was driven by a fall in repayments of £1.3 billion by the OFC sector.

Chart 6: Equity issuance by UK residents (all currencies)

Non seasonally adjusted

Advertisement

Advertisement