Bangladesh Faces Financial Crisis as Banks Stop Circulating New Currency Notes

| ➡️ Get instant news updates on Whatsapp. Click here to join our Whatsapp Group. |

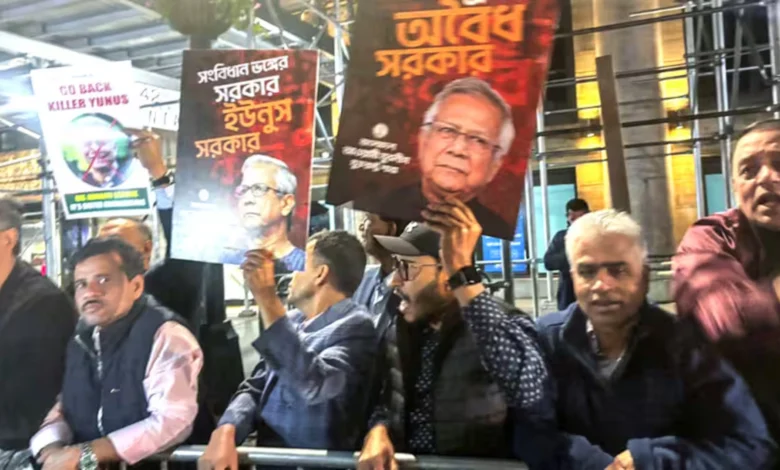

Bangladesh is going through a serious financial crisis under the interim government led by Muhammad Yunus. According to local media reports on Monday, banks across the country are unable to circulate new currency notes, which has created big problems for citizens and businesses.

This crisis began after a major political change last year, when former Prime Minister Sheikh Hasina was removed from power following a violent uprising. Since then, the country’s financial system has been under a lot of pressure.

Why New Currency Notes Are Not Circulating

One of the main reasons for the shortage of new currency is because the existing stock of new notes and coins features the image of Bangabandhu Sheikh Mujibur Rahman, the founding father of Bangladesh. A leading Bangladeshi newspaper, Prothom Alo, reported that the new government has decided not to release these notes into the market.

Due to this decision, shops and banks are flooded with old, torn, and dirty notes. People are unable to access fresh currency, causing them financial losses. Businesses are struggling, and customers are finding it difficult to use damaged notes in their daily transactions.

Central Bank’s Role in the Crisis

Last month, Bangladesh Bank, the country’s central bank, ordered all scheduled banks to stop exchanging new notes with the public. Instead, banks were told to keep the fresh notes in their vaults and use only re-circulated old notes for cash transactions.

Since that order, the flow of new currency into the market has completely stopped. Local media reports say that millions of fresh banknotes with Bangabandhu’s image are locked away in banks, unused.

Ziauddin Ahmed, a former Managing Director of the Mint, said, “The mint does not have the capacity to cancel all these notes and print new ones quickly. To ease people’s suffering, the printed notes should be released into the market.”

Huge Financial Loss for Bangladesh

Reports suggest that by not using the already printed notes, Bangladesh is facing huge financial losses. It is estimated that about 15,000 crore Bangladeshi taka worth of notes are sitting unused because they carry Sheikh Mujibur Rahman’s image.

Sources inside the Bangladesh Bank, speaking anonymously to Prothom Alo, said that this decision was made at the government’s highest levels. Many bank officials admitted that the sudden halt in the circulation of new notes has created a major crisis, leading to wastage of already printed money and increased customer hardship.

ATM Machines Also Issuing Old, Damaged Notes

The problem is not limited to banks. ATM machines across Bangladesh are now dispensing old, damaged, and nearly unusable notes. Customers are frustrated because banks are also refusing to accept these bad notes when they try to exchange them.

One customer shared his experience: “I withdrew 20,000 taka from a bank ATM using my Dhaka Bank card. Out of the money, three notes of 1,000 taka were so damaged that they are almost unusable. When I tried to return them, the bank refused to take them back.”

Conclusion

The decision to stop circulating new currency notes has triggered a financial crisis in Bangladesh, causing major inconvenience for ordinary people and businesses. Unless the government and Bangladesh Bank find a quick solution, the situation is likely to worsen in the coming weeks.