The Indian stock market witnessed a strong rally today, April 21, 2025. Both the Sensex and Nifty 50 recorded impressive gains. The Sensex rose by over 1,000 points, while the Nifty 50 climbed past the 24,150 level, marking the fifth consecutive day of gains.

This surge in the market is not random. Several key factors are driving this momentum. Let’s understand these in detail.

1. Strong Q4 Results from Leading Banks

The main reason behind the rally is the robust quarterly results (Q4 FY25) from major Indian banks like HDFC Bank and ICICI Bank.

- HDFC Bank posted a solid rise in its net profit, thanks to healthy loan growth, lower bad loans (NPAs), and stable interest income.

- ICICI Bank also reported strong numbers, with a rise in net interest income and improved asset quality.

These results show that the banking sector is performing well, which is crucial because banks form a large part of the stock indices. Investors see this as a sign of strength in the Indian economy.

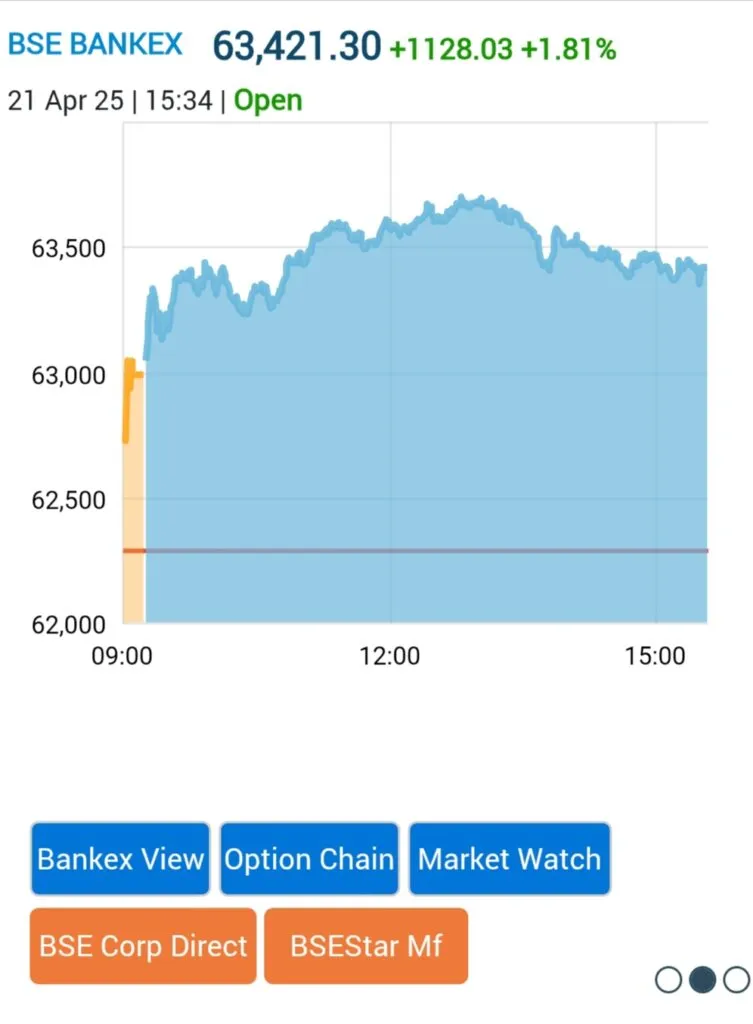

2. Nifty Bank Hits Record High

The Nifty Bank index — which tracks top banking stocks — surged to a record high of 55,453 today. Almost all banking stocks, including SBI, Axis Bank, and Kotak Mahindra Bank, traded in the green.

This shows that investor confidence in the banking sector is at a high level. A strong banking sector usually indicates a healthy economy, which attracts more investment.

3. Foreign Investors Buying Aggressively

Foreign Institutional Investors (FIIs) have been net buyers in the Indian stock market. In the last few sessions, they have bought Indian equities worth ₹4,600 crore.

This is a big positive sign because when global investors put their money into Indian stocks, it shows they trust the country’s growth prospects. Their buying also boosts market liquidity and pushes prices higher.

4. Weakening U.S. Dollar Helps

The U.S. Dollar Index has weakened slightly, which makes emerging markets like India more attractive to global investors. A weaker dollar means higher capital inflows into India.

Also, this eases pressure on the Indian rupee and supports sectors like IT and pharma that earn revenue in dollars.

5. Recovery from Global Shocks

Earlier this month, markets were shaken by news of possible trade tariffs from the U.S. on some Asian exports. However, those fears have eased, and the Indian market has fully recovered from that dip.

Investors are now focusing on positive domestic triggers instead of global uncertainty.

6. Technical Indicators Show Strength

Technical analysts say that the Nifty has strong support at 23,500 and may touch 24,200 in the short term. Bank Nifty also looks bullish.

When charts and patterns look positive, traders and institutions tend to enter the market more aggressively.

7. Expectations from Upcoming Results

After HDFC Bank and ICICI Bank, investors are now looking forward to Q4 results from Reliance Industries, Axis Bank, and Infosys. Positive expectations are already being priced into the market.

A good earnings season can sustain the rally for the coming weeks.

8. Global and Domestic Sentiment Favorable

Even though global markets are facing mixed cues due to interest rate worries in the U.S. and oil price fluctuations, India stands out as a strong, resilient economy.

The low inflation, stable interest rates, and rising consumption in India make it a preferred destination for investment.

Conclusion

The sharp rise in the Indian stock market today is a result of multiple positive developments — strong banking results, foreign investor inflows, technical strength, and a supportive macroeconomic environment.

It shows that investor confidence in India’s growth story remains strong. If earnings continue to surprise on the upside and global risks stay under control, this momentum may continue in the near future.