Why Banks need multiple Apps? RBI asks Banks to Explain

The Reserve Bank of India (RBI) has recently raised a key question with several banks: Should banks be running multiple mobile apps that target the same set of customers?

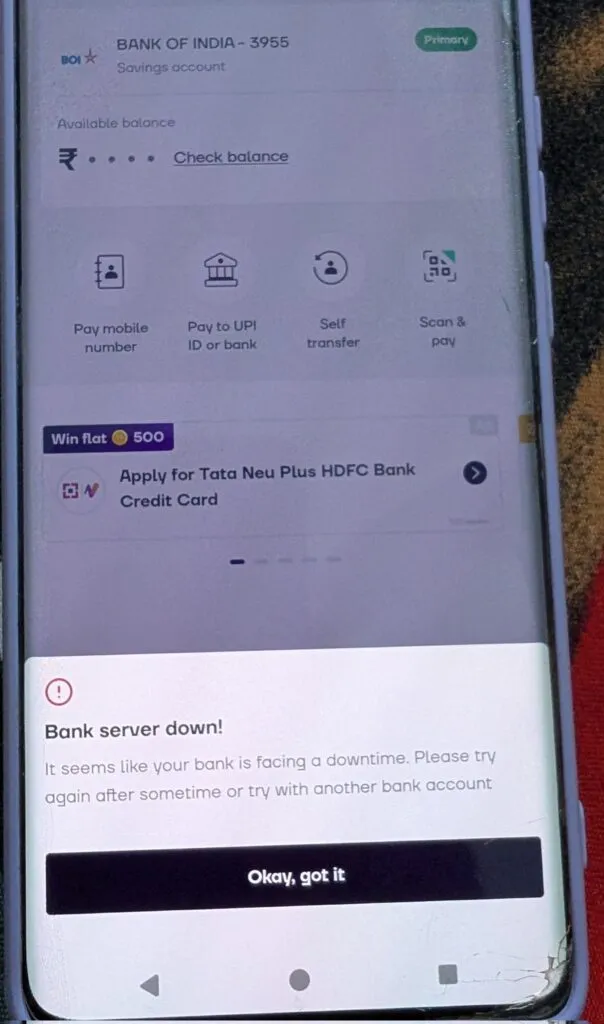

This question comes at a time when many banks are facing issues with the performance and reliability of their mobile banking apps. These disruptions have affected customer experience, leading the RBI to take a closer look at how banks are managing their digital platforms.

Why Is RBI Concerned About Multiple Banking Apps?

According to sources familiar with the matter, the RBI is not officially issuing any new rules yet. Instead, it has informally asked banks to review and explain why they need more than one app aimed at the same group of users—mainly retail customers.

The main concern is about duplication of resources. Maintaining two similar apps requires additional spending on technology, staff, and management. This can lower the overall efficiency and user experience of both apps.

Examples of Overlapping Apps

There are many examples of banks operating more than one app for retail users:

- Kotak Mahindra Bank has both the Kotak app and Kotak 811 app.

- IndusInd Bank runs both the IndusInd Bank app and the Indie app.

- HDFC Bank has the HDFC Bank app and also Payzapp, another app for retail banking and payments.

These apps often offer very similar services like checking account balances, transferring money, and making bill payments. So, the RBI is asking—what’s the point of having two apps that do nearly the same thing?

Banks Defend Their Strategy, But RBI Wants Rethink

Some banks believe that this is an internal decision and part of their own business strategy. In fact, a few years ago, some banks created separate digital units just to manage these new apps. The goal was to build “digital banks within banks” and increase their market value.

However, the RBI has not fully supported this approach. It is also concerned that splitting up teams, budgets, and technology between two apps may not be a smart long-term plan. In the end, it could hurt the quality of service for customers.

Banks Given Time Until June to Respond

Although the RBI hasn’t issued a formal directive yet, it may take a more official position in the future. For now, banks have been given time until June to reply to the regulator’s query and possibly reconsider their digital app strategy.

When media reached out to the RBI for comments or confirmation on this issue, there was no official response.

What This Means for Customers and the Banking Sector

This development highlights how the RBI is paying close attention to digital banking practices. With more people using mobile apps for banking, the central bank wants to make sure that these platforms are efficient, secure, and user-friendly.

Banks may now have to streamline their digital services and avoid unnecessary duplication to meet RBI’s expectations.