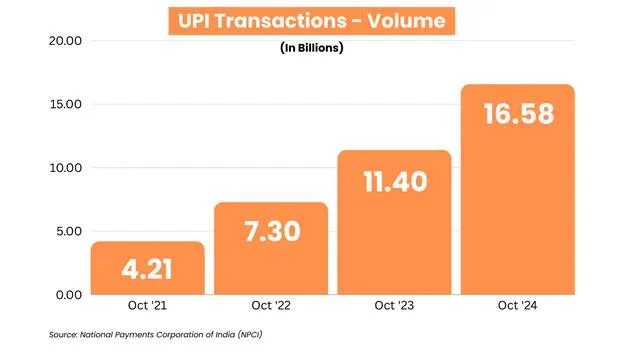

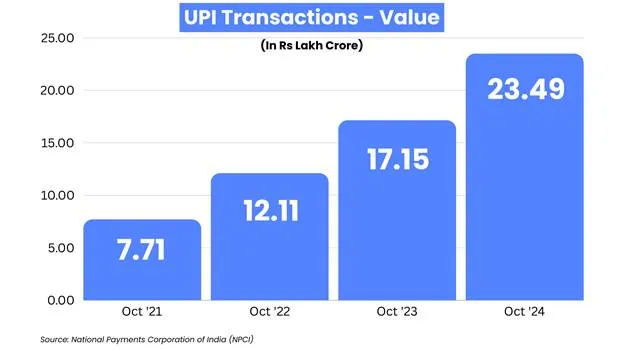

UPI October 2024 Data: UPI crossed 16 billion transactions worth Rs 23.49 Lakh Crores in October 2024

In October 2024, the Unified Payments Interface (UPI) reached a groundbreaking milestone, processing 16.58 billion financial transactions in a single month. This achievement underscores UPI’s central role in India’s digital transformation. Launched in 2016 by the National Payments Corporation of India (NPCI), UPI has redefined the payment landscape by seamlessly integrating multiple bank accounts into a single mobile application. It facilitates quick and secure fund transfers, merchant payments, and peer-to-peer transactions while offering users the flexibility of scheduled payment requests.

Beyond transforming how transactions are conducted, UPI has empowered individuals, small businesses, and merchants, driving India toward a cashless economy. This milestone exemplifies the nation’s dedication to leveraging technology for inclusive economic growth and development.

UPI Data

In October 2024, UPI facilitated transactions worth an astounding ₹23.49 lakh crore, reflecting a 45% year-on-year increase from the 11.40 billion transactions recorded in October 2023. With 632 banks connected to its platform, UPI continues to dominate India’s payment ecosystem. As more individuals and businesses adopt the ease and security of digital payments, UPI’s growing transaction volume and value reinforce its critical role in shaping India’s cashless future.

| Month | No. of Banks live on UPI | Volume (in Mn) | Value (in Cr.) |

|---|---|---|---|

| Oct-24 | 632 | 16,584.97 | 23,49,821.46 |

| Sep-24 | 622 | 15,041.75 | 20,63,994.71 |

| Aug-24 | 608 | 14,963.05 | 20,60,735.57 |

| Jul-24 | 605 | 14,435.55 | 20,64,292.41 |

| Jun-24 | 602 | 13,885.14 | 20,07,081.20 |

| May-24 | 598 | 14,035.84 | 20,44,937.05 |

| Apr-24 | 581 | 13,303.99 | 19,64,464.52 |

| Mar-24 | 572 | 13,440.00 | 19,78,353.23 |

| Feb-24 | 560 | 12,102.67 | 18,27,869.35 |

| Jan-24 | 550 | 12,203.02 | 18,41,083.97 |

UPI’s Global Expansion

India’s digital payments revolution is steadily gaining global traction, with UPI and RuPay making significant strides across borders. Currently, UPI operates in seven countries, including major markets like the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius.

The entry into France is a particularly noteworthy milestone, marking UPI’s debut in Europe. This move allows Indian consumers and businesses to conduct seamless transactions while living or traveling abroad, further enhancing UPI’s global appeal.

As part of its international push, Prime Minister Narendra Modi has actively advocated for UPI’s adoption within the BRICS alliance, which recently welcomed six new member states. This strategic initiative aims to strengthen cross-border remittance flows, advance financial inclusion, and elevate India’s position in the global financial ecosystem.

According to the ACI Worldwide Report 2024, India accounted for approximately 49% of global real-time payment transactions in 2023, underscoring its leadership in digital payment innovation. With UPI’s growing international footprint and the continued rise of digital transactions, India is setting new benchmarks for financial inclusion and economic empowerment on the global stage.