Union Bank decides to Impose Tax on Interest-Free Loans for Employees

Union Bank of India has announced the implementation of perquisite tax on interest-free and concessional loans provided to employees, following the Hon’ble Supreme Court’s judgment dated May 7, 2024. This decision is based on Section 17(2) of the Income Tax Act, 1961, which includes benefits like free or concessional loans under the definition of “perquisites.”

Right now, Public Sector Banks in India offer interest free loans to their Employees or loans at concessional rate of interest to their employees. For example – In case of Car Loan, Normal public has to pay Compound Rate of Interest of approximately 9% whereas Bank Employees need to pay Simple Interest of 5%. Not only Banks, even LIC offers loans at concessional rate of interest to its Employees.

This is a perquisite offered by Bank to its Employees and it’s important also. Various companies in the world offer various forms of incentives to their employees. Some organisations even offer 1 month extra salary to their employees. This year itself, a lot of companies offered huge benefits to their employees in Diwali. Flipkart has offered shares to its Employees who have earned huge profits from it. Government Employees are deprived from these benefits. Loans at Concessional Rate of Interest helped Banks to retain Talented Staff. It was a sort of perk offered to Employees.

But now, the Banks have decided to impose tax on it. Means the employees will have to pay tax on the amount saved via less rate of interest. For example – In case of car loan, if normal public paid Rs.10,000 interest and Bank Employees paid Rs.2000 interest, then Bank Employees will have to pay tax on Rs.8000 saved. This will be counted as income of Bank Employees.

This is a good news for government as government will get more tax but it will increase tax burden on Bank Employees. Banks need talented staff to improve the economy of India. If such perks are not provided then the talented staff will move to other organisations. Apart from this, there is no such perk or incentive offered to Bank Employees as per industry standards. The salary of PSU Bank Employees is already less as compared to private Banks and such decisions may negatively impact the performance of Banks. Now let’s understand few important things about this Perquisite Tax.

Key Guidelines for Perquisite Taxation

Applicability of Perquisite Value

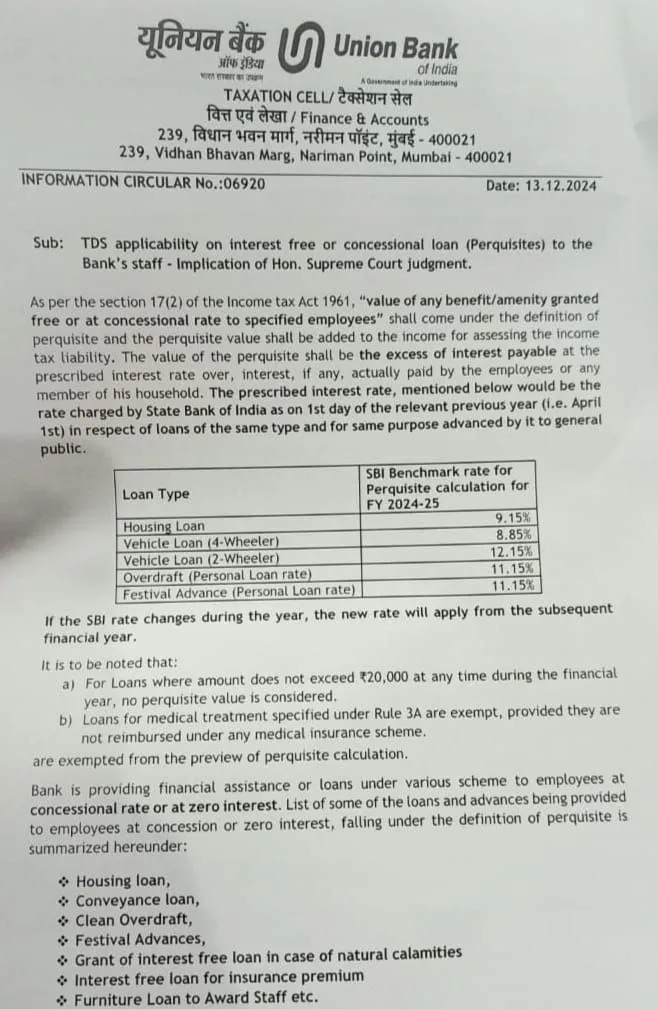

- The perquisite value is calculated as the difference between the interest payable at the State Bank of India’s (SBI) benchmark rate and the interest, if any, paid by the employee.

- SBI benchmark rates for loans for FY 2024-25:

- Housing Loan: 9.15%

- 4-Wheeler Loan: 8.85%

- 2-Wheeler Loan: 12.15%

- Overdraft/Personal Loan: 11.15%

- Festival Advance: 11.15%

Exemptions:

- Loans of up to ₹20,000 during the financial year will be exempted from this tax.

- Loans for medical treatment as specified under Rule 3A, provided they are not reimbursed by insurance.

Loans Covered Under the Perquisite Tax

The following loan schemes provided by Union Bank to employees fall under the definition of perquisites:

- Housing loans.

- Conveyance loans.

- Festival advances.

- Clean overdraft.

- Interest-free loans for insurance premiums or natural calamities.

- Furniture loans for award staff.

Methodology for Perquisite Calculation

Loans with Concessional Interest Rates:

- The difference between the employee interest rate and the SBI benchmark rate will be applied to the principal outstanding as of the last day of each month. The tax on the difference will be imposed.

- For housing loans under moratorium, the calculation will be based on the principal without considering reductions during the moratorium period.

Interest-Free Loans:

- The entire interest amount, calculated using the SBI benchmark rate, will be added as perquisite value to the employee’s taxable income.

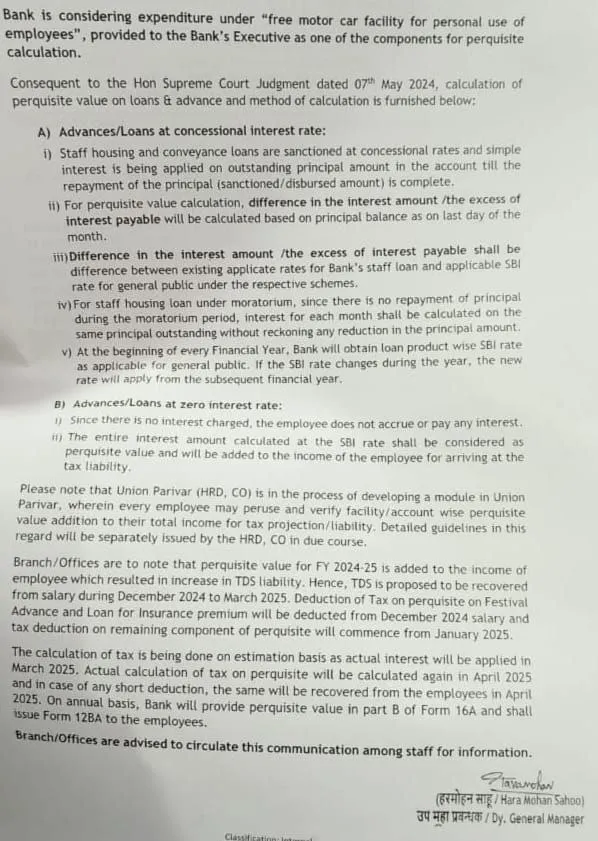

Tax Deduction and Recovery

- The bank will recover TDS on perquisites from employee salaries between December 2024 and March 2025.

- Festival advance and insurance premium loans will be taxed starting December 2024, while other components will be taxed from January 2025.

- Final adjustments for TDS will be made in April 2025 based on actual interest calculations.