Rs.425 crore Bank Loan Default by Coffee Day

Coffee Day Enterprises Ltd (CDEL), the company behind the Café Coffee Day chain, has said that it has not been able to pay back loans and interest worth ₹425.38 crore as of March 31, 2025. These unpaid amounts include loans taken from banks, financial institutions, and investments like non-convertible debentures (NCDs) and non-convertible redeemable preference shares (NCRPS).

The company explained that it is facing a serious cash shortage, which is why it has not been able to make these payments. This situation is known as a liquidity crisis, meaning the company doesn’t have enough money on hand to pay off its debts on time.

Because of this delay in repaying loans and interest, the lenders (banks and financial companies) have taken action. They have sent loan recall notices, which means they are demanding immediate repayment of the entire outstanding loan amount. Some lenders have also started legal cases against the company.

Since the loans are under dispute and the company is trying to settle everything with the lenders through a one-time settlement, CDEL has stopped recording interest payments in its accounts from April 2021 onwards.

Here’s a breakdown of the defaults:

- ₹174.83 crore default on the main loan amount (principal) taken from banks and financial institutions.

- ₹5.78 crore default on the interest on those loans.

- ₹200 crore default on unlisted debt securities (like NCDs and NCRPS).

- ₹44.77 crore default on the interest related to those unlisted securities.

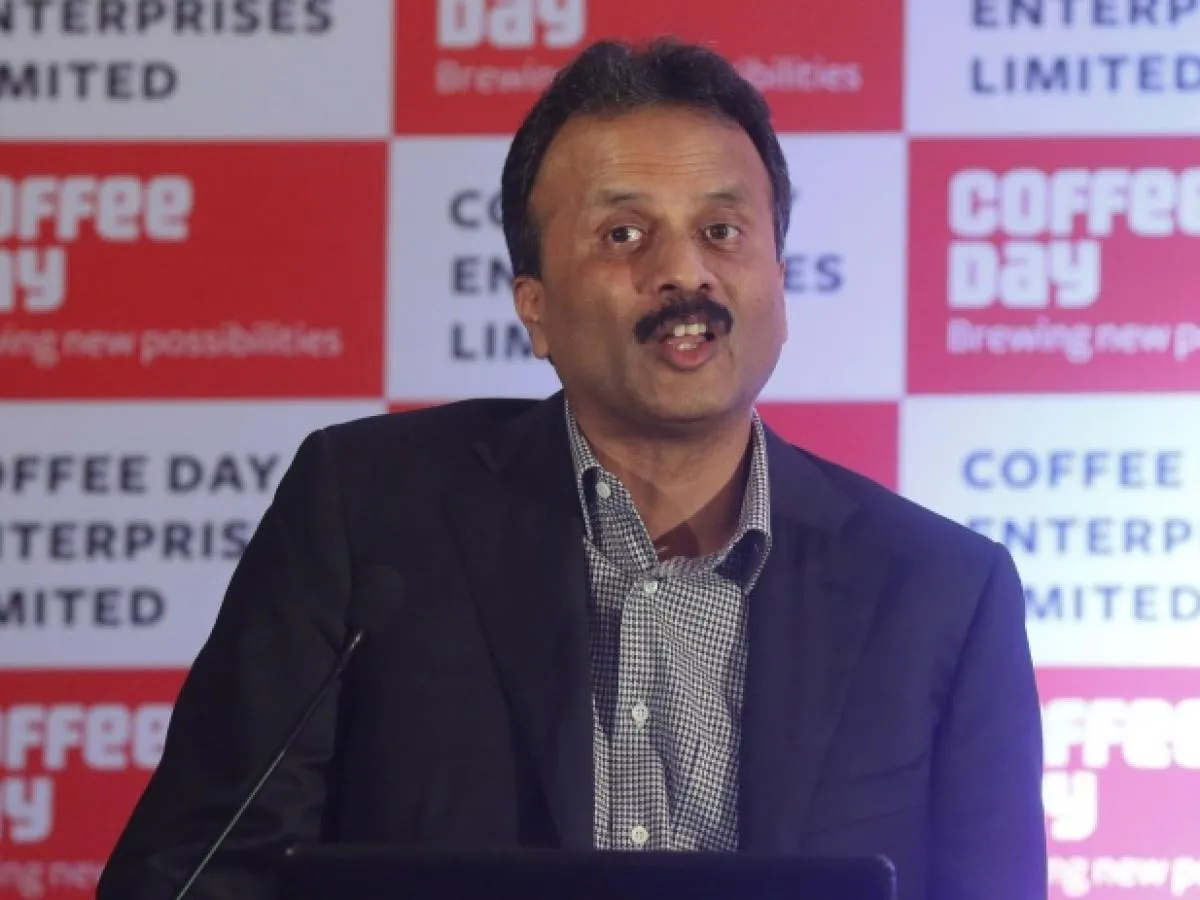

This financial trouble started after the founder and chairman, V G Siddhartha, passed away in July 2019. Since then, the company has been trying to sell off assets and pay off its debts.

In February 2025, the National Company Law Appellate Tribunal (NCLAT) cancelled an earlier decision that allowed starting insolvency proceedings against the company. Earlier, on August 8, 2024, the Bengaluru branch of the National Company Law Tribunal (NCLT) had allowed a plea from IDBI Trusteeship Services Ltd (IDBITSL), which claimed that CDEL had defaulted on ₹228.45 crore. NCLT had even appointed a person to handle the company’s operations during the debt crisis.

However, CDEL immediately challenged this decision, and on August 14, 2024, the NCLAT put a stay on the insolvency proceedings, meaning the process was temporarily stopped.

In the past, in March 2020, CDEL had managed to repay ₹1,644 crore to 13 lenders after selling its technology business park to Blackstone Group. The company is also trying to legally recover over ₹3,535 crore that was allegedly diverted from CDEL to another company, Mysore Amalgamated Coffee Estates Ltd (MACEL). MACEL is a private firm that was owned by the late V G Siddhartha.