Rs.4000 crore Loan Fraud in Union Bank of India

The Enforcement Directorate (ED) has taken action against Nagpur businessman Manoj Jayaswal and his company, Corporate Power Limited (CPL). Assets valued at Rs 209 crore have been frozen, and Rs 55 lakh in cash has been seized. The ED has described these assets as the proceeds of crime, specifically from a loan fraud case where approximately ₹4,000 crore was allegedly diverted from a public sector unit (PSU) bank – Union Bank of India.

The Enforcement Directorate’s (ED) Nagpur sub-zonal office carried out three days of search operations from August 12 to August 14 at 14 official and residential premises in Nagpur, Kolkata, and Vishakhapatnam as part of a money laundering investigation.

Scope of the Fraud

The total fraud amount escalates to over Rs 11,300 crore when including interest. The seized financial assets include shares of listed companies, mutual funds, and fixed deposits, as per the ED’s press release.

Involvement of Jayaswal’s Family

Charges have also been brought against Manoj Jayaswal’s sons, Abhijeet and Abhishekh. The investigation uncovered that CPL used a complex network of 250 shell companies and 20 charitable organizations to launder money.

Raids and Revelations

Raids were conducted on the company’s premises in Nagpur, Kolkata, and Vishakapattanam, leading to the discovery of the fraudulent activities. The Abhijeet Group, led by Manoj Jayaswal, was one of the primary beneficiaries of the controversial coal block allocation scheme under the UPA regime and has since been listed among the top bank defaulters in India.

Financial Misconduct

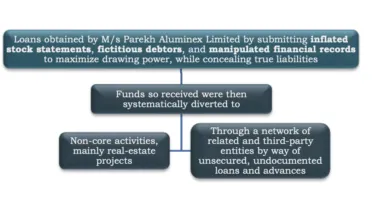

CPL, which borrowed from Union Bank, ended up in default. The Central Bureau of Investigation (CBI) had previously registered a case against CPL promoters for manipulating project costs and financial statements to secure loans, which were subsequently diverted, causing a Rs 4,000 crore loss to Union Bank. Including interest, the loss totals Rs 11,379 crore.

Additional Bank Frauds

Further investigations revealed two more bank frauds involving Rs 136 crore and Rs 180 crore through other group companies—Corporate Ispat Alloys Limited (CIAL) and Abhijeet Integrated Steel Limited (AISL), respectively.

Shell Companies and Fictitious Transactions

The ED’s investigation revealed the promoters’ involvement in fictitious transactions in CPL’s books and related entities. A network of 250 shell companies was used for layering, integrating, and utilizing the proceeds of crime. These shell companies also facilitated the introduction of share premiums and inflated balance sheets, which allowed CPL to secure fresh bank loans.

Use of Charitable Institutions

The ED identified a network of 20 charitable institutions that acted as conduits for the illicit funds. The funds were parked in immovable properties, shares, and mutual funds.

Historical Context and Current Status

Manoj Jayaswal came into prominence after the coal allocation scam was exposed over a decade ago, with the Abhijeet Group receiving several coal blocks. Plans for a power plant in Latehar, Jharkhand, were stalled after coal blocks were repossessed, leading to loan defaults and allegations of loan diversion against the companies.