RBI Monetary Policy Statement: Repo Rate Unchanged, Check Details Here

The Monetary Policy Committee (MPC) held its 57th meeting from September 29 to October 1, 2025, under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC members Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta and Shri Indranil Bhattacharyya attended the meeting.

The minutes of the MPC’s meeting will be published on October 15, 2025. The next meeting of the MPC is scheduled during December 3 to 5, 2025.

After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, the MPC voted unanimously to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 5.50 per cent; consequently, the standing deposit facility (SDF) rate remains at 5.25 per cent while the marginal standing facility (MSF) rate and the Bank Rate remains at 5.75 per cent. The MPC also decided to continue with the neutral stance.

| Policy Repo Rate | : 5.50% |

|---|---|

| Standing Deposit Facility Rate | : 5.25% |

| Marginal Standing Facility Rate | : 5.75% |

| Bank Rate | : 5.75% |

| Fixed Reverse Repo Rate | : 3.35% |

Growth and Inflation Outlook

The global economy has been more resilient than anticipated in 2025, with robust growth in the US and China. The outlook, however, remains clouded amidst elevated policy uncertainty. Inflation has remained above their respective targets in some advanced economies, posing fresh challenges for central banks as they navigate the shifting growth-inflation dynamics. Financial markets have been volatile. The US dollar strengthened after the upward revision of US growth numbers for the second quarter, and treasury yields hardened recently tracking changes in policy rate expectations. Equities have remained buoyant across several advanced and emerging market economies.

In India, real gross domestic product (GDP), driven by strong private consumption and fixed investment, recorded a robust growth of 7.8 per cent in Q1:2025-26. On the supply side, growth in gross value added (GVA) at 7.6 per cent was led by a revival in manufacturing and steady expansion in services. Available high frequency indicators suggest that economic activity continues to remain resilient. Rural demand remains strong, riding on a good monsoon and robust agriculture activity, while urban demand is showing a gradual revival. Revenue expenditure of the Union and State Governments registered robust growth during the fiscal year so far (April-July). Investment activity, as suggested by healthy growth in construction indicators i.e., cement production and steel consumption in July-August, is holding up well even though production and import of capital goods witnessed some moderation. Recovery in manufacturing sector continues while services activity is sustaining its momentum.

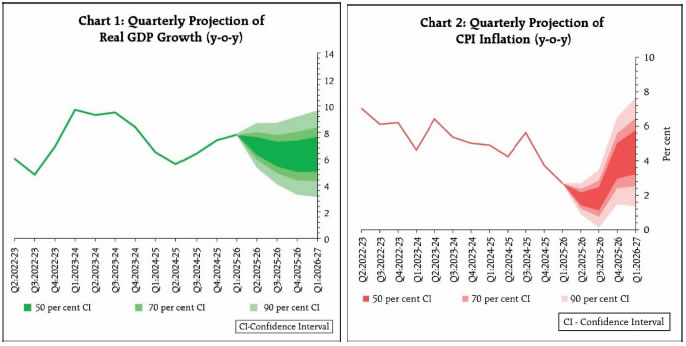

Looking ahead, an above normal monsoon, good progress of kharif sowing and adequate reservoir levels have further brightened prospects of agriculture and rural demand. Buoyancy in services sector coupled with steady employment conditions are supportive of demand, which is expected to get a further boost from the rationalisation of goods and services tax (GST) rates. Rising capacity utilisation, conducive financial conditions, and improving domestic demand should continue to facilitate fixed investment. However, ongoing tariff and trade policy uncertainties will impact external demand for goods and services. Prolonged geopolitical tensions and volatility in international financial markets caused by risk-off sentiments of investors also pose downside risks to the growth outlook. The implementation of several growth-inducing structural reforms, including streamlining of GST are expected to offset some of the adverse effects of the external headwinds. Taking all these factors into account, real GDP growth for 2025-26 is now projected at 6.8 per cent, with Q2 at 7.0 per cent, Q3 at 6.4 per cent, and Q4 at 6.2 per cent. Real GDP growth for Q1:2026-27 is projected at 6.4 per cent. The risks are evenly balanced.

Headline CPI inflation declined to its eight-year low of 1.6 per cent (y-o-y) in July 2025 before rising to 2.1 per cent in August – its first increase after nine months. Benign inflation conditions during 2025-26 so far have been primarily driven by a sharp decline in food inflation from its peak of October 2024. Inflation within the fuel group moved in a narrow range of 2.4-2.7 per cent during June-August. Core inflation remained largely contained at 4.2 per cent in August. Excluding precious metals, core inflation was at 3.0 per cent in August.

In terms of the inflation outlook for H2: 2025-26, healthy progress of the south-west monsoon, higher kharif sowing, adequate reservoir levels and comfortable buffer stock of foodgrains should keep food prices benign. The recently implemented GST rate rationalisation would lead to a reduction in prices of several items in the CPI basket. Overall, the inflation outcome is likely to be softer than what was projected in the August MPC resolution, primarily on account of the GST rate cuts and benign food prices. Despite the anticipation of moderate momentum during H2, large unfavourable base effects are likely to exert upward pressure on headline CPI inflation, especially in Q4. Considering all these factors, CPI inflation for 2025-26 is now projected at 2.6 per cent with Q2 at 1.8 per cent; Q3 at 1.8 per cent; and Q4 at 4.0 per cent. CPI inflation for Q1:2026-27 is projected at 4.5 per cent (Chart 2). The risks are evenly balanced.

Rationale for Monetary Policy Decisions

The MPC observed that the overall inflation outlook has turned even more benign in the last few months, due to the reasons discussed above. The average headline inflation for 2025-26 is now revised lower from 3.7 per cent and 3.1 per cent projected in June and August policy, respectively, to 2.6 per cent. Headline inflation for Q4:2025-26 and Q1:2026-27 too have been revised downwards and are broadly aligned with the target, despite unfavourable base effects. Core inflation for this year and Q1:2026-27 is also expected to remain contained.

Growth outlook remains resilient supported by domestic drivers, despite weak external demand. It is likely to get further support from a favourable monsoon, lower inflation, monetary easing and the salubrious impact of recent GST reforms. However, growth continues to be below our aspirations. Even though the growth projection for the financial year 2025-26 is being revised upwards, the forward-looking projections for Q3 and beyond are expected to be slightly lower than projected earlier, primarily due to tariff-related developments, despite being partially offset by the impetus provided by the rationalisation of GST rates.

To summarize, there has been a significant moderation in inflation. Moreover, the prevailing global uncertainties and tariff related developments are likely to decelerate growth in H2:2025-26 and beyond. The current macroeconomic conditions and the outlook has opened up policy space for further supporting growth. However, the MPC noted that the impact of the front-loaded monetary policy actions and the recent fiscal measures is still playing out. The trade related uncertainties are also unfolding. The MPC, therefore, considered it prudent to wait for the impact of policy actions to play out and greater clarity to emerge before charting the next course of action. Accordingly, the MPC unanimously voted to keep the policy repo rate unchanged at 5.5 per cent. The MPC also decided to retain the stance at neutral. However, two members – Dr. Nagesh Kumar and Prof. Ram Singh, were of the view that the stance be changed from neutral to accommodative.