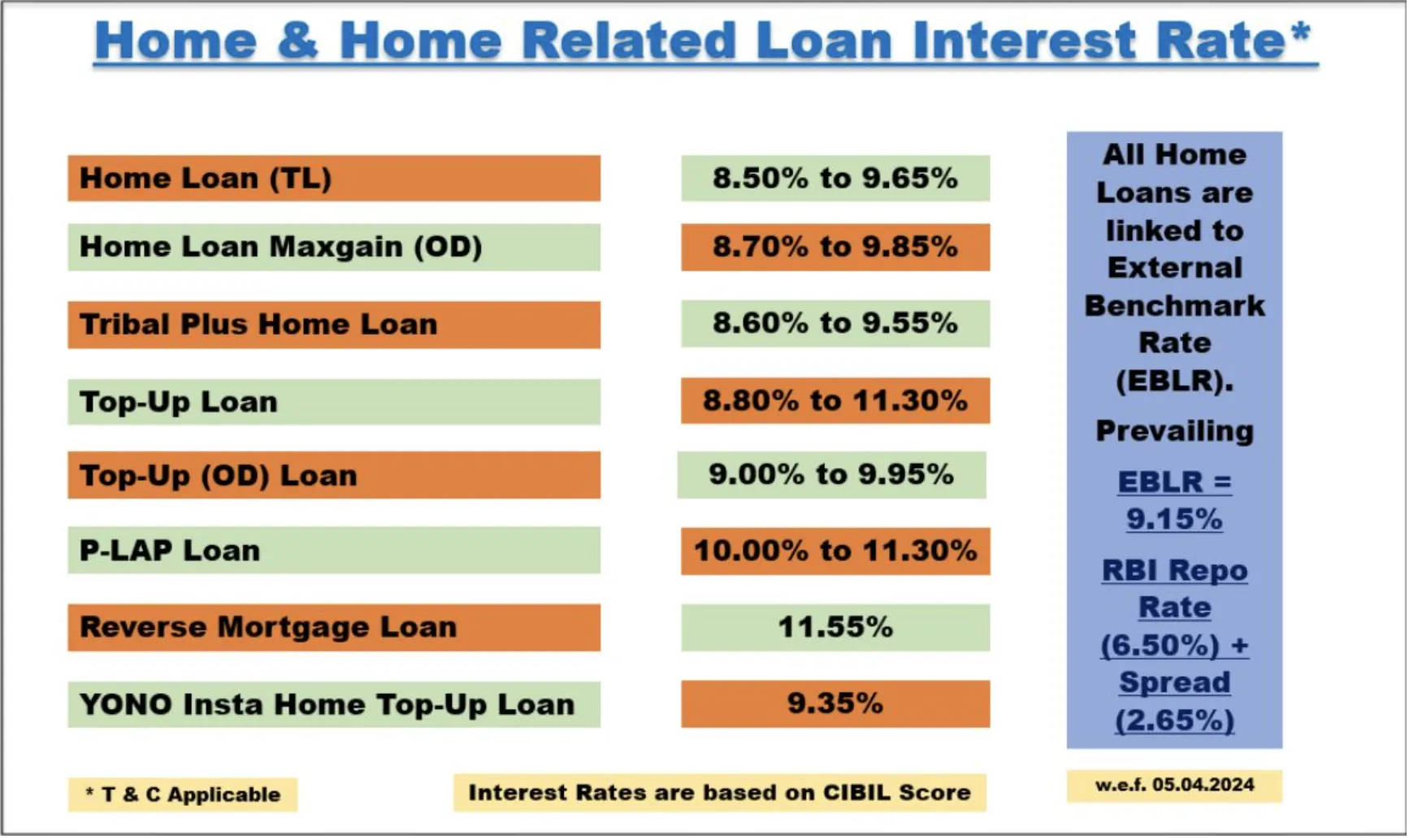

In a significant move for State Bank of India (SBI) customers, the bank has raised its lending rates, affecting home loans and other long-term loans. SBI has announced a 0.05% increase in the marginal cost of fund-based lending rate (MCLR) for certain tenors. Effective Friday, the one-year MCLR has been raised by 0.05% to 9%, which is a crucial benchmark for long-term loans such as home loans.

This increase follows a trend, with SBI having raised its MCLR twice recently, driven by the rising cost of deposits due to stiff competition among banks for customers’ funds. The bank has indicated that these rising deposit rates could lead to higher lending rates.

SBI Chairman C S Setty revealed that 42% of the bank’s loans are linked to the MCLR, with the remaining loans tied to external benchmarks. Setty also mentioned that deposit rates have likely reached their peak and that SBI will no longer use interest rates as a primary tool to attract new customers.

Additionally, SBI has increased the MCLR for three- and six-month terms but has kept the rates unchanged for overnight, one-month, two-year, and three-year terms.