Government will not reduce the eligibility age of Additional Pension Benefits for Govt Employees

The Government of India has clarified its position on additional pension benefits for senior citizens receiving government pensions. This comes in response to a question raised in the Lok Sabha regarding the eligibility age for these benefits and whether it could be lowered.

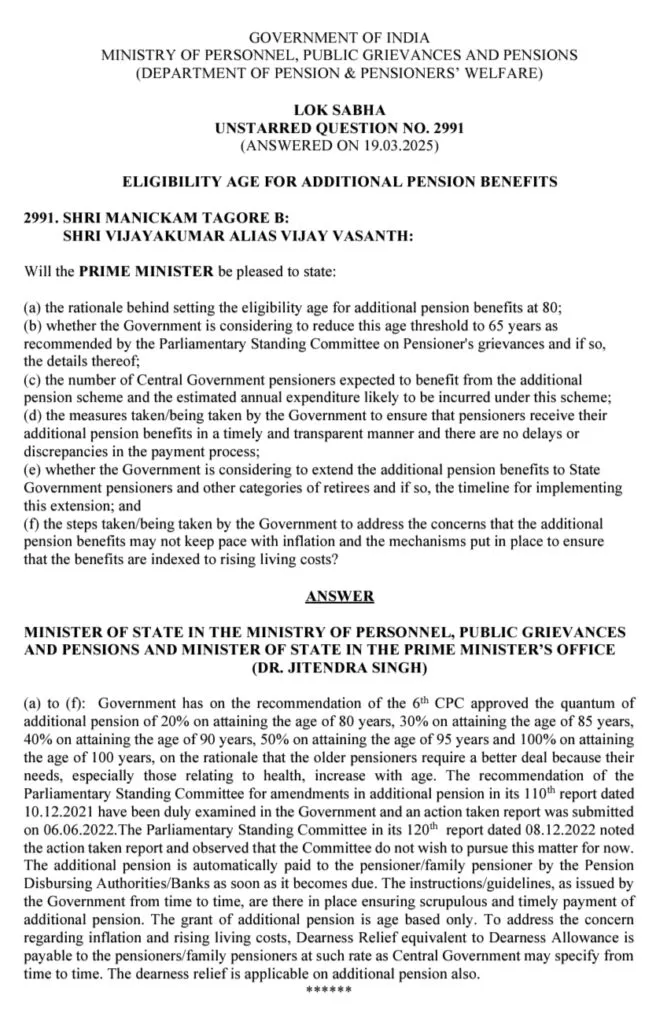

The Ministry of Personnel, Public Grievances, and Pensions has stated that the government currently provides additional pension benefits to pensioners starting from the age of 80 years. This decision was made based on recommendations from the 6th Central Pay Commission (CPC). However, concerns were raised about whether this benefit should start earlier, especially at 65 years, as suggested by the Parliamentary Standing Committee on Pensioner’s Grievances.

Why is the Eligibility Age for Additional Pension Set at 80?

The government has explained that as pensioners grow older, their financial needs, especially related to healthcare and daily living expenses, increase significantly. To support them, an additional pension is provided in a phased manner as they age. The structure of the additional pension is as follows:

- 20% increase in pension at the age of 80 years

- 30% increase at 85 years

- 40% increase at 90 years

- 50% increase at 95 years

- 100% increase (double pension) at 100 years

This policy was introduced to ensure financial support for older pensioners, as their medical and other expenses tend to rise with age.

Will the Government Reduce the Eligibility Age to 65 Years?

The Parliamentary Standing Committee on Pensioner’s Grievances had earlier recommended lowering the eligibility age for additional pension benefits to 65 years. This was discussed in its 110th report on December 10, 2021. However, after examining this proposal, the government decided not to implement this change.

The government submitted an action taken report on June 6, 2022, stating that it had considered the recommendation but found no need to lower the eligibility age. The 120th report of the committee (dated December 8, 2022) also noted this response and decided not to pursue the matter further for now.

How is Additional Pension Paid?

The additional pension is automatically credited to eligible pensioners and family pensioners. The Pension Disbursing Authorities (PDA), including banks and post offices, are responsible for ensuring timely payments.

To prevent delays and errors, the government has issued strict guidelines to banks and pension authorities. These guidelines ensure that pensioners receive their additional pension as soon as they reach the eligible age, without requiring them to submit additional paperwork.

Will State Government Pensioners Get Additional Pension Benefits?

Currently, additional pension benefits are given only to Central Government pensioners. However, many people have asked whether similar benefits will be extended to State Government pensioners and other retirees.

The government has not made any decision on this yet. There is no official timeline for extending these benefits to State Government pensioners. If a decision is made in the future, the government will issue a formal notification.

How is the Government Addressing Rising Living Costs for Pensioners?

One major concern is that additional pension benefits may not be enough to keep up with inflation and rising costs of living. The government has assured pensioners that they are protected against inflation through Dearness Relief (DR).

Dearness Relief is similar to Dearness Allowance (DA), which is given to government employees. The Central Government reviews and revises DR rates periodically to ensure pensioners can cope with inflation. The good news is that Dearness Relief is also applied to the additional pension, so pensioners continue to receive financial support as prices rise.

Final Thoughts

The government’s decision to provide age-based additional pension is aimed at helping elderly pensioners manage their expenses, particularly medical costs. While some pensioners have requested that the eligibility age be reduced to 65 years, the government has decided to stick with the current policy, starting additional pension at 80 years.

For pensioners, it is important to know that:

- Additional pension is automatically credited when they reach the eligible age.

- Dearness Relief (DR) helps pensioners keep up with inflation.

- State Government pensioners are not yet included, but any future changes will be announced officially.

While there are concerns about rising living costs, the combination of additional pension and DR adjustments helps pensioners manage their finances in their later years.