Government has increased Excise Duty on Petrol and Diesel, Will Petrol be more costly now?

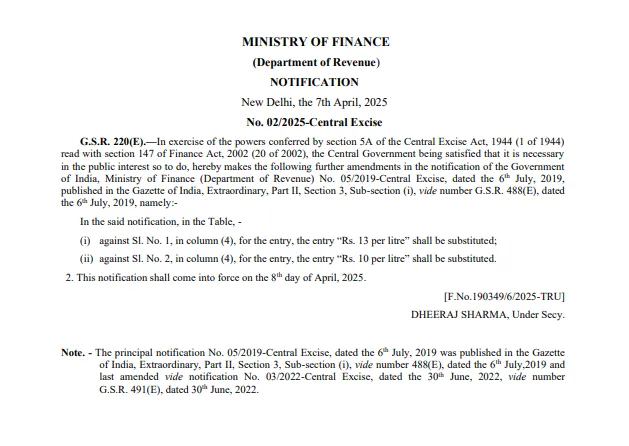

The Indian government has increased the excise duty on petrol and diesel by ₹2 per litre. This will be applicable from 8th April 2025. This means that the tax collected by the central government on every litre of petrol and diesel has gone up. Now, the excise duty on petrol is ₹13 per litre, and for diesel, it is ₹10 per litre.

This step was taken due to the current situation in the global oil market, where oil prices are going up and down unpredictably. Also, international developments like tariffs imposed by former U.S. President Donald Trump are affecting global trade and prices. In this scenario, the Indian government is trying to increase its income by collecting more tax from fuel, which will help in managing the country’s finances better.

Even though global crude oil prices have fallen to their lowest levels since April 2021, the benefit of this price drop will not be passed on to consumers. Instead, the government has chosen to use the opportunity to boost its revenue by raising excise duties.

Many people were concerned about whether this tax hike would lead to an increase in the price of petrol and diesel at the pump (i.e., the price we pay as consumers). But the Petroleum Ministry quickly clarified that there will be no change in the retail prices for now. They said that the Public Sector Oil Marketing Companies (OMCs) have confirmed that the price consumers pay for petrol and diesel will remain the same despite the increase in excise duty.

The Ministry of Petroleum and Natural Gas also shared this information on social media platform X (formerly Twitter), confirming that retail prices will not be affected by this decision.

So, to summarize, although the government has increased fuel tax to raise revenue, the prices for consumers will not increase at this time. The new tax rates are effective from April 8, 2025.