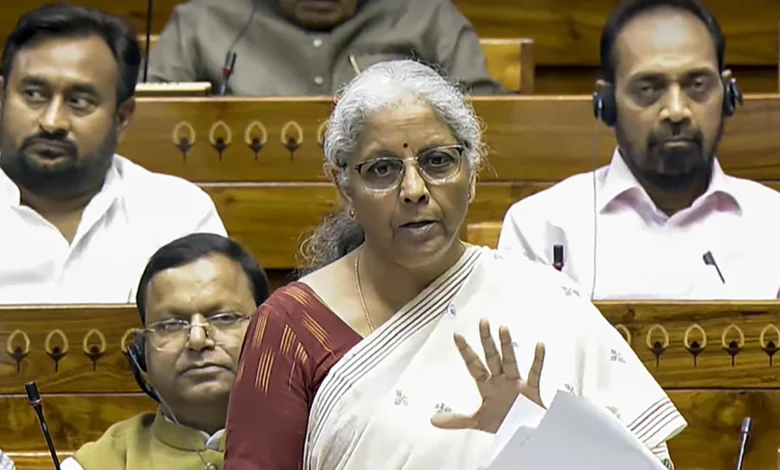

Finance Minister Nirmala Sitharaman Orders Gold Loan Audits for Public Sector Banks, No Major Issues Found Till Now

Union Finance Minister Nirmala Sitharaman recently addressed concerns related to the gold loan portfolios of public sector banks (PSBs) and shared updates on banking reforms. She emphasized that public sector banks have been asked to conduct thorough audits of their gold loan portfolios to ensure they follow all the rules and regulations set by the Reserve Bank of India (RBI). Fortunately, no major issues or lapses have been found so far in these audits.

The country’s biggest lender, State Bank of India (SBI) alone has a gold loan portfolio of Rs 30,881 crore as of December 2023.

Punjab National Bank’s gold loan exposure stood at Rs 5,315 crore while Bank of Baroda was at Rs 3,682 crore at the end of third quarter.

This announcement came while Sitharaman was replying to discussions on the Banking Laws (Amendment) Bill, 2024, in the Rajya Sabha. After the discussion, the Bill was passed by voice vote. Earlier, the Lok Sabha had already approved the Bill in December 2023.

Key Changes Proposed in the Banking Laws (Amendment) Bill

The Bill aims to introduce 19 amendments to important banking laws. This includes changes to:

- The Reserve Bank of India Act

- The Banking Regulation Act

- The Banking Companies (Acquisition and Transfer of Undertakings) Act

These amendments are intended to modernize banking regulations and improve the overall efficiency and accountability of banks.

Significant Growth in Gold Loans

The gold loan portfolios of banks have grown rapidly. By December 2024, these portfolios increased by 71.3% year-on-year, reaching a total of ₹1.72 trillion. This sharp rise was due to increasing gold prices and a slowdown in unsecured loans after the RBI raised risk weights (a measure used to assess loan risk) on such loans last year.

In 2023, the RBI had advised banks and non-banking financial companies (NBFCs) to closely review their gold loan policies and identify any weaknesses. They were also asked to fix any gaps in a timely manner.

Steps Taken by RBI and Government

To address any potential risks in gold loans, both the RBI and the government have introduced several measures:

- Strengthening the process of evaluating loan applications.

- Ensuring accurate valuation of gold.

- Complying with loan-to-value (LTV) norms (which determine how much loan a borrower can get based on the value of their gold).

- Taking appropriate actions, such as auctioning the gold, in cases where borrowers fail to repay the loans.

RBI is also planning to ask Banks to follow stricter underwriting processes for gold loans and monitor the end-use of funds as it tries to reduce growth in the fast-growing segment, seven people, including industry sources and those aware of the regulator’s thinking, said.

The Reserve Bank of India wants banks and non-banks to perform background checks on borrowers and ascertain the ownership of the gold that is being mortgaged. RBI wants that Banks should check whether Gold belongs to that person only or not.

Since September 2024, banks’ gold loans have been rising by 50%, sharply outpacing the growth in overall loans.

The Department of Financial Services (DFS) in a communication addressed to heads of public sector banks has asked them to look at their system and processes related to gold loan.

The DFS urged banks to undertake a thorough review of the last two-year period from January 1, 2022 to January 31, 2024 so as to ensure that all gold loans were disbursed in compliance with regulatory requirements and internal policies of banks.