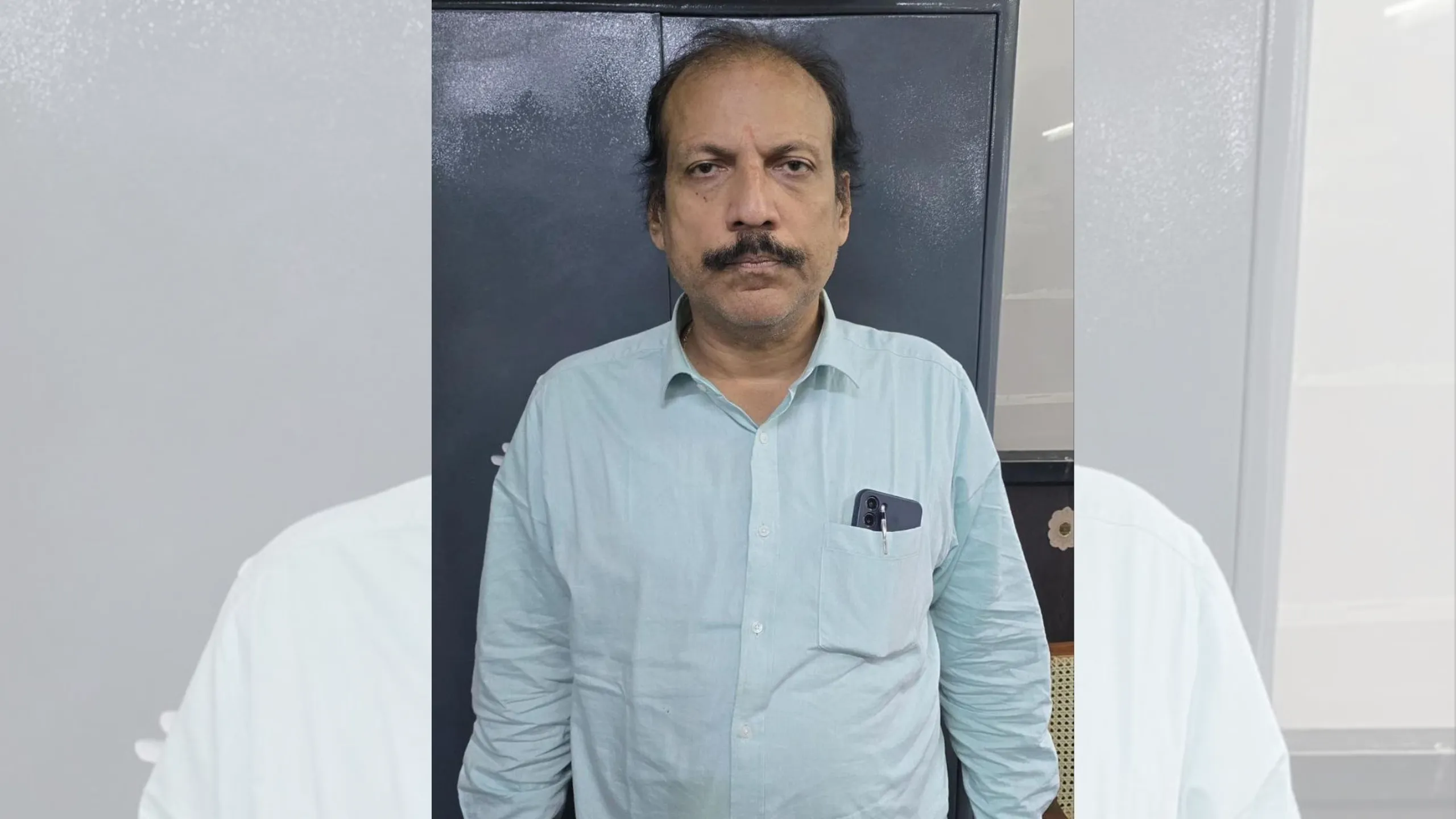

Chennai: The Bank Fraud Wing of the Central Crime Branch has apprehended a former Assistant General Manager (AGM) of Bank of Baroda, B. Radhakrishnan, in connection with a bank fraud case involving ₹1.8 crore. The 61-year-old ex-banker, who previously served at the Egmore Branch, was arrested in Hyderabad and transported to Chennai for further investigation.

Details of the Fraud

The case originated from a complaint lodged by Leena Gohain, an Assistant General Manager and branch head at the Bank of Baroda. The complaint alleged that Lemooria Foods Pvt. Ltd., a company claiming to manufacture “Ready to Drink fruit juice and juice powder,” had fraudulently obtained a loan of ₹2.6 crore under the pretext of purchasing machinery for a plant in the SIDCO Industrial Estate in Pattaravakkam, Ambattur.

According to the complaint, the loan was sanctioned in May 2018 by the bank’s Corporate Branch. The company’s directors, G. Rajalakshmi and K. Sathish Babu, purportedly used the loan to purchase equipment for their manufacturing unit. However, investigations revealed that the promised machinery was never purchased. Furthermore, the company defaulted on repayments, leaving an outstanding amount of ₹1.8 crore.

The complaint alleged that the fraud was orchestrated as part of a well-planned criminal conspiracy involving the company, its directors, and other accomplices. The directors, along with others, were accused of deliberately causing a wrongful loss to the bank while securing undue financial gains for themselves.

Role of the Former AGM

Radhakrishnan, as the then AGM of the Egmore Branch, was directly implicated in the case. Police investigations suggest that he colluded with the company’s directors during the loan sanctioning process, bypassing necessary due diligence. His alleged involvement made him a prime suspect in the fraud, as his actions facilitated the financial irregularities that led to the significant loss. The police stated that Radhakrishnan had been absconding since the case came to light. His arrest marks a critical step in unraveling the network of collusion behind the fraud.

- Also Read: Indian Bank Advocate sent to 3 years Jail for submitting Wrong Legal Opinion in Loan

- Also Read: CBI Court Sentenced Indian Overseas Bank Chief Manager to 3 Years Jail

- Also Read: SBI AGM sent to Jail by CBI Court

Earlier Arrests in the Case

The case has already seen the arrest of K. Sathish Babu, one of the directors of Lemooria Foods Pvt. Ltd., along with three other accomplices. The arrests followed an intensive investigation into the company’s activities and the loan utilization.

Implications and Further Investigations

This case highlights the vulnerabilities in loan sanctioning processes and the potential for insider collusion in financial frauds. The involvement of a senior banking official like Radhakrishnan underscores the need for stricter checks and balances within banking institutions to prevent such malpractices.

The police have stated that further investigations are underway to uncover additional links and individuals involved in the conspiracy. The arrest of Radhakrishnan is expected to shed more light on the extent of the fraud and the mechanisms used to manipulate the system.

The Bank of Baroda has reiterated its commitment to cooperating with law enforcement agencies and ensuring justice in the case. Meanwhile, the bank continues to strengthen its internal controls to safeguard against such incidents in the future.

Analysis of the Case

This incident serves as a reminder of the critical importance of transparency and accountability in the banking sector. Fraudulent activities, especially when aided by insiders, not only erode the trust of customers but also jeopardize the financial stability of institutions. With high-value loans becoming a target for fraudulent schemes, the role of regulatory oversight becomes even more crucial in preventing such cases.

As the investigation unfolds, this case is likely to bring into focus broader issues of governance within banks and the measures needed to curb financial fraud.