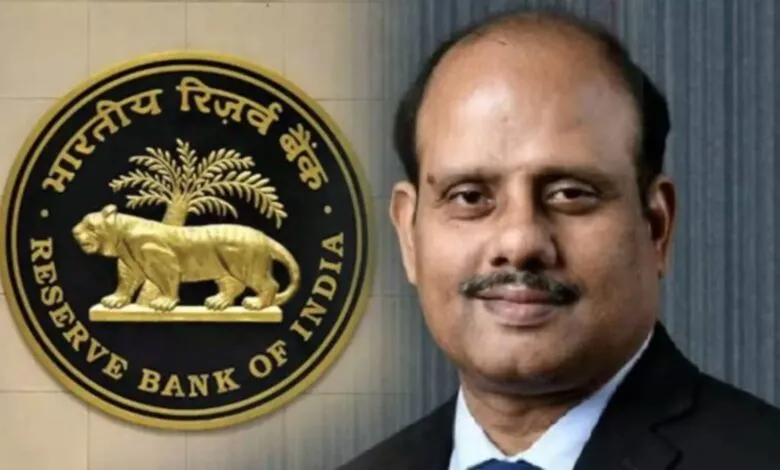

The attrition rate in private sector banks has improved compared to the previous financial year, but significant challenges remain in retaining talent, according to Reserve Bank of India (RBI) Deputy Governor Swaminathan J. Speaking at a conference for private sector bank directors on Monday, he emphasized that the average attrition rate in private banks stood at 25% in FY 2024, with some banks witnessing even higher rates over the last three years.

“While we have observed some improvement following our discussions last year with selected entities, there is still a long way to go. Attrition rates are more than just numbers; they reflect deeper issues in how banks engage and retain employees,” Swaminathan said in his speech, which was later uploaded to the RBI website.

Attrition Trends and Initiatives

In FY24, HDFC Bank reduced its attrition rate by 7% year-on-year to 27%, though the rate for women employees remained slightly higher at 28% compared to 27% for men. The highest turnover was among employees under 30 years, followed by those in the 30–50 age group.

The bank also invested heavily in enhancing the employee experience across all stages of the employee lifecycle. Initiatives included:

- Improved onboarding processes.

- Mpower learning platform for professional development.

- An active listening framework to stay connected with employee needs.

Over 65 lakh learning hours were clocked by the bank’s workforce of over 2 lakh employees in FY24, alongside the launch of an AI-based learning platform, which saw an 86% adoption rate within its first month.

Performance Across Other Private Banks

Several private sector banks also reported notable improvements in attrition rates:

- ICICI Bank: Reduced attrition by 6% to 25%.

- Axis Bank: Improved by 6%, bringing attrition to 29%.

- Kotak Mahindra Bank (KMB): Attrition declined by 6% to 40%, though it remained the highest among major private banks.

- IndusInd Bank: Achieved a significant 14% reduction, bringing attrition to 37%.

- YES Bank: Reduced attrition by 5% to 38%.

To address high turnover, KMB launched specialized programs targeting career growth in frontline, relationship, and customer experience roles. It also introduced tailored initiatives for branch and elite relationship managers, as well as for emerging market and acquisition roles, resulting in several internal role transitions.

Talent Loss and Its Implications

The Deputy Governor warned that high attrition, particularly among junior and frontline staff, could lead to loss of experience, weakened customer relationships, and disruptions in operational continuity.

“This impacts customer ownership and often results in subpar experiences at frontline counters,” he noted, stressing that reducing attrition is a strategic imperative, not merely an HR task.

He urged banks to focus on initiatives that prioritize career development, mentorship, competitive benefits, and a workplace culture that makes employees feel valued.